Bitcoin guide for new users

In this article, we review some important history and features of Bitcoin for newcomers. We also look at how Bitcoin enables financial sovereignty and freedom. Finally, we explore the challenges facing Bitcoin and its future potential.

The Bitcoin network

Bitcoin the network officially started on January 3, 2009, when the pseudonymous developer Satoshi Nakamoto created the first block of the Bitcoin blockchain.

The Bitcoin blockchain is the public ledger that records all historic transactions. Satoshi received the first 50 bitcoins (BTC), the network’s token asset, as a reward for mining this block. Since then, over 840,000 blocks have been added, resulting in over 19 million bitcoins, all created through mining.

There are four main players in the Bitcoin network: developers, full nodes, miners, and bitcoin users.

In the early days, Satoshi played all the roles to kickstart the network. But because Bitcoin is an open permissionless network, more and more people joined by contributing to the codebase, running full nodes, mining, or transacting with bitcoin. By the end of 2010, Satoshi voluntarily disappeared, never again moving the 1 million bitcoins that he had mined and ending his influence on how Bitcoin develops. The Bitcoin network has now grown to tens of thousands of nodes run by individuals and organizations around the world with tens of millions of users. This decentralized network is the key to Bitcoin’s long-term security and reliability.

Importance of decentralization

Bitcoin has a system of checks and balances among the developers, full node operators, and mining node operators. Developers can update the open source Bitcoin code but cannot force their updates on the node operators. Miners are needed to keep adding new blocks that confirm new transactions. Full nodes have the most power over the state of the network by enforcing rules and approving new blocks from miners.

Price cycles

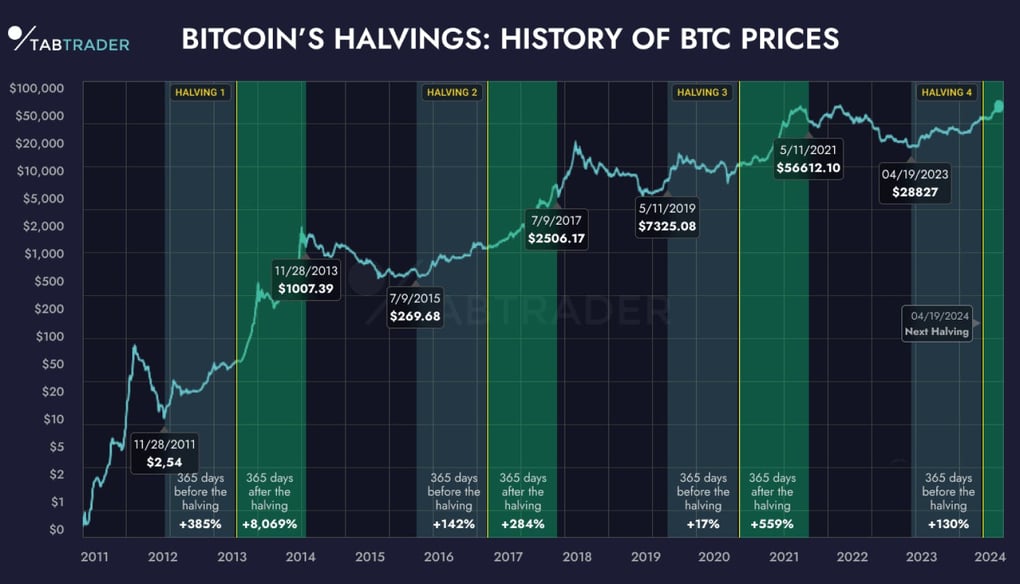

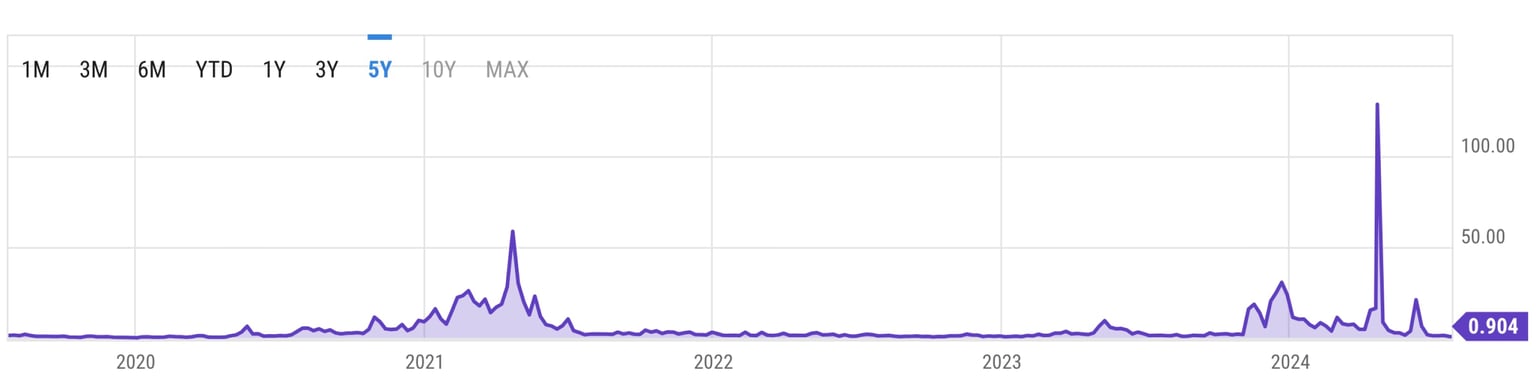

Bitcoin the digital asset has a market value determined by supply and demand. In the early days of Bitcoin, there wasn’t any demand so bitcoins were worth nothing. As of July 2024, one can sell a bitcoin for around $60,000 USD, which means all 21 million bitcoins would have a market cap of around $1.2 trillion USD.

As a new asset that’s neither backed by anything nor forced on people by their government, it’s inevitable that its market price will be very volatile. Below is a graph of bitcoin price in USD on a log scale. You can see it has been trending up with distinct four-year cycles that correlate with the halvings.

Source: Tab Trader(new window)

Financial sovereignty and freedom

While BTC price gains are what first attracts many newcomers, Bitcoin’s potential to bring financial sovereignty and freedom to billions of people is perhaps even more interesting to understand.

Source: Seeking Alpha(new window)

Challenges for Bitcoin

In this section, we review the major challenges facing Bitcoin and how they may be overcome.

Source: Ycharts.com(new window)

The web of value

In the 1990’s, the invention of the World Wide Web by Tim Berners-Lee allowed information to easily flow on the internet. It introduced the masses to use websites to read the news, play games, or send emails. Individuals and organizations could easily set up web servers and mail servers and be connected on a global information network that was open to all.

What was missing was a permission less way for people to freely send value over the internet. Unfortunately, without easy-to-use digital money to pay for services, we ended up paying for “free” products with our attention and data. Many internet companies adopted the advertising business model, which inevitably pressured them to invade users’ privacy in order to maximize profits.

The reason many people are excited about Bitcoin is because of its potential to become the global value network that would allow us to freely send value and payments on the internet.

The first part of this process is making a valuable digital asset that people will want. This has mostly been accomplished in the 15 years since Satoshi mined the first BTC in 2009.

The second part of this process is making it easy for anyone to adopt Bitcoin and use it for payments. This is the main challenge in the next 15 years that will determine whether or not Bitcoin can succeed.