Průvodce Bitcoinem pro nováčky

V tomto článku se zabýváme důležitou historií a funkcemi Bitcoinu pro nové uživatele. Také se zaměřujeme na to, jak Bitcoin umožňuje finanční suverenitu a svobodu. A konečně také zkoumáme výzvy, kterým Bitcoin čelí a jaký je jeho budoucí potenciál.

Síť Bitcoin

Síť Bitcoin byla oficiálně spuštěna 3. ledna 2009, kdy pseudonymní vývojář Satoshi Nakamoto vytvořil první blok bitcoinového blockchainu.

Bitcoinový blockchain je veřejná účetní kniha, která zaznamenává všechny historické transakce. Jako odměnu za vytěžení tohoto bloku získal Satoshi prvních 50 bitcoinů (BTC), což je tokenové aktivum sítě. Od té doby bylo přidáno více než 840 000 bloků, což vyústilo ve více než 19 milionů bitcoinů, které byly vytvořeny těžbou.

V síti bitcoin jsou čtyři hlavní hráči: vývojáři, plné uzly, těžaři a uživatelé bitcoinů.

V prvních dnech hrál Satoshi všechny role při rozjezdu sítě. Protože je však bitcoin otevřená síť bez oprávnění, připojovalo se k ní stále více lidí, kteří přispívali do kódové základny, provozovali plné uzly, těžili nebo prováděli transakce s bitcoiny. Koncem roku 2010 Satoshi dobrovolně zmizel a už nikdy nepřevedl milion bitcoinů, které vytěžil, a ukončil svůj vliv na vývoj Bitcoinu. Síť Bitcoin se nyní rozrostla na desítky tisíc uzlů provozovaných jednotlivci a organizacemi po celém světě s desítkami milionů uživatelů. Tato decentralizovaná síť je klíčem k dlouhodobé bezpečnosti a spolehlivosti bitcoinu.

Význam decentralizace

Bitcoin má systém kontroly a rovnováhy mezi vývojáři, provozovateli plných uzlů a provozovateli těžebních uzlů. Vývojáři mohou aktualizovat otevřený zdrojový kód Bitcoinu, ale nemohou své aktualizace vnutit provozovatelům uzlů. Těžaři jsou potřební k neustálému přidávání nových bloků, které potvrzují nové transakce. Plné uzly mají největší moc nad stavem sítě tím, že prosazují pravidla a schvalují nové bloky od těžařů.

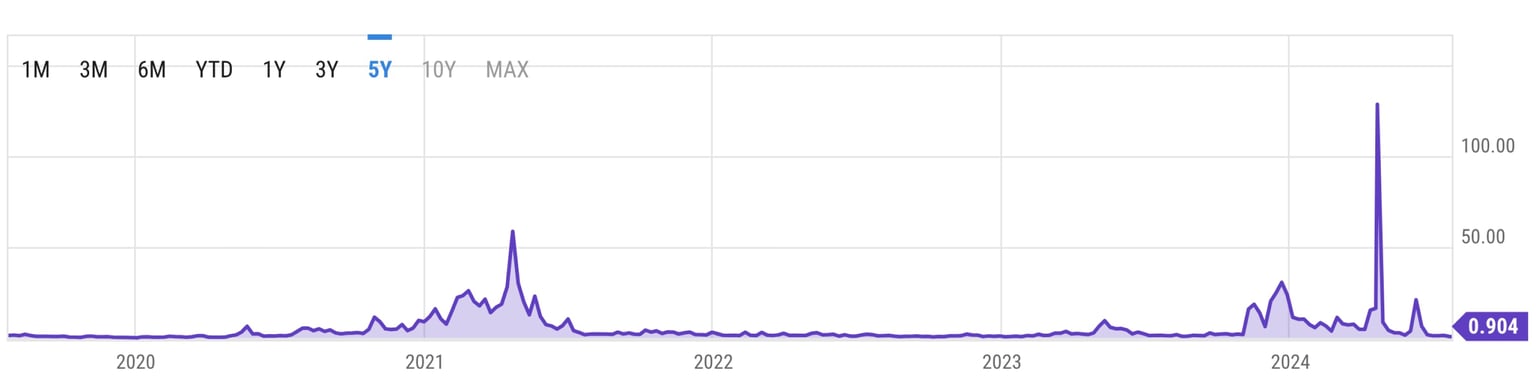

Cenové cykly

Tržní hodnota digitálního aktiva bitcoin se řídí nabídkou a poptávkou. V počátcích bitcoinu nebyla žádná poptávka, takže bitcoiny neměly žádnou hodnotu. V červenci 2024 bude možné prodat jeden bitcoin za přibližně 60000 USD, což znamená, že tržní hodnota všech 21 milionů bitcoinů bude činit přibližně 1,2 bilionu USD.

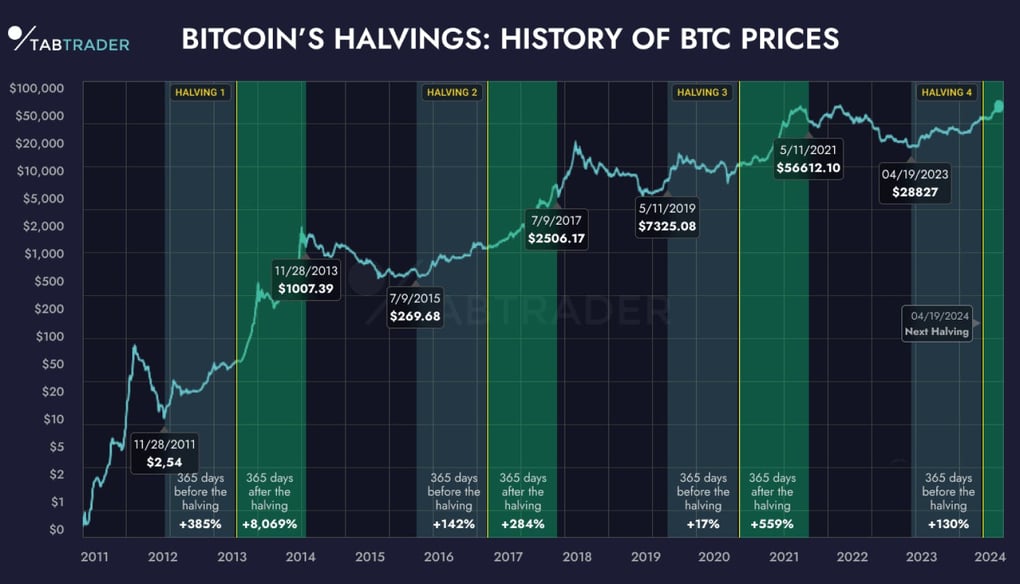

Vzhledem k tomu, že se jedná o nové aktivum, které není ničím kryté ani vnucené lidem jejich vládou, je nevyhnutelné, že jeho tržní cena bude velmi volatilní. Níže je graf ceny bitcoinu v USD v logaritmickém měřítku. Je vidět, že má vzestupnou tendenci s výraznými čtyřletými cykly, které korespondují s půlrokem.

Zdroj: Tab Trader(nové okno)

Finanční suverenita a svoboda

I když je růst ceny BTC tím, co jako první přitahuje mnoho nováčků, potenciál Bitcoinu přinést finanční suverenitu a svobodu miliardám lidí je možná ještě zajímavější pochopit.

Zdroj: Seeking Alpha(nové okno)

Výzvy pro Bitcoin

V této části se seznámíme s hlavními problémy, kterým bitcoin čelí, a s možnostmi jejich překonání.

Zdroj: Ycharts.com(nové okno)

Síť hodnot

V 90. letech 20. století vynalezl Tim Berners-Lee World Wide Web, který umožnil snadný tok informací na internetu. Zavedl masové používání webových stránek ke čtení zpráv, hraní her nebo posílání e-mailů. Jednotlivci a organizace si mohli snadno zřídit webové a poštovní servery a být připojeni ke globální informační síti, která byla otevřená všem.

Chyběl způsob, jakým by lidé mohli volně posílat hodnoty přes internet bez povolení. Bohužel bez snadno použitelných digitálních peněz k placení za služby jsme nakonec zaplatili za "bezplatné" produkty svou pozorností a daty. Mnoho internetových společností přijalo reklamní obchodní model, který je nevyhnutelně tlačí k narušování soukromí uživatelů za účelem maximalizace zisku.

Důvodem, proč se mnoho lidí těší na Bitcoin, je jeho potenciál stát se globální hodnotovou sítí, která by nám umožnila volně posílat hodnoty a platby na internetu.

První částí tohoto procesu je vytvoření hodnotného digitálního aktiva, které budou lidé chtít. To se většinou podařilo za 15 let od roku 2009, kdy Satoshi vytěžil první BTC.

Druhou částí tohoto procesu je usnadnění přijetí Bitcoinu a jeho používání k platbám. To je hlavní výzva pro příštích 15 let, která rozhodne o tom, zda Bitcoin uspěje, nebo ne.