Europe’s tech sovereignty watch

For decades, Europe turned to US tech instead of investing at home. Today, that choice threatens its economic stability, cybersecurity, and democratic sovereignty.

Over 74% of all publicly listed European companies depend on US-based tech services, like Google and Microsoft. This means their sensitive business data, including the 117 emails workers receive on average each day, budgets, client lists, and memos from the CEO, are exposed to:

AI training

Foreign pressure

Warrantless surveillance

Digital sovereignty is an illusion when Europe’s infrastructure is controlled from abroad. To secure its future, Europe must invest in European solutions.

Which countries rely most on US tech?

Proton analyzed business email domains across Europe to show how many publicly listed companies are reliant on US email and email security services. We looked at email because it’s often the gateway to a company’s tech stack. When a company chooses an email service, it often uses the entire suite.

Top US tech usage

Bad for Europe — and your business

When your company relies on US tech companies, you’re not just outsourcing tech. You’re exposing your organization to strategic risks that are out of your control:

Your sensitive information could be used to train AI

You’re vulnerable in times of geopolitical tension

Your sensitive information is subject to US legal overreach

You’re fueling a brain drain out of Europe

You’re limiting European innovation

Control your data to control your future

Proton gives European businesses a secure, fully featured alternative to US Big Tech. We are headquartered in Switzerland, and our services are end-to-end encrypted and GDPR compliant by design.

With Proton, you can:

Avoid exposure to US surveillance and government overreach (unlike Google or Microsoft)

Host your data entirely in Europe, protected by EU and Swiss law

Secure your emails, files, and other sensitive data with end-to-end encryption and zero-access architecture

Verify our open-source and independently audited code

Use enterprise-ready services, with easy migration tools and full admin control

Take control of your data to protect yourself from foreign interference.

France

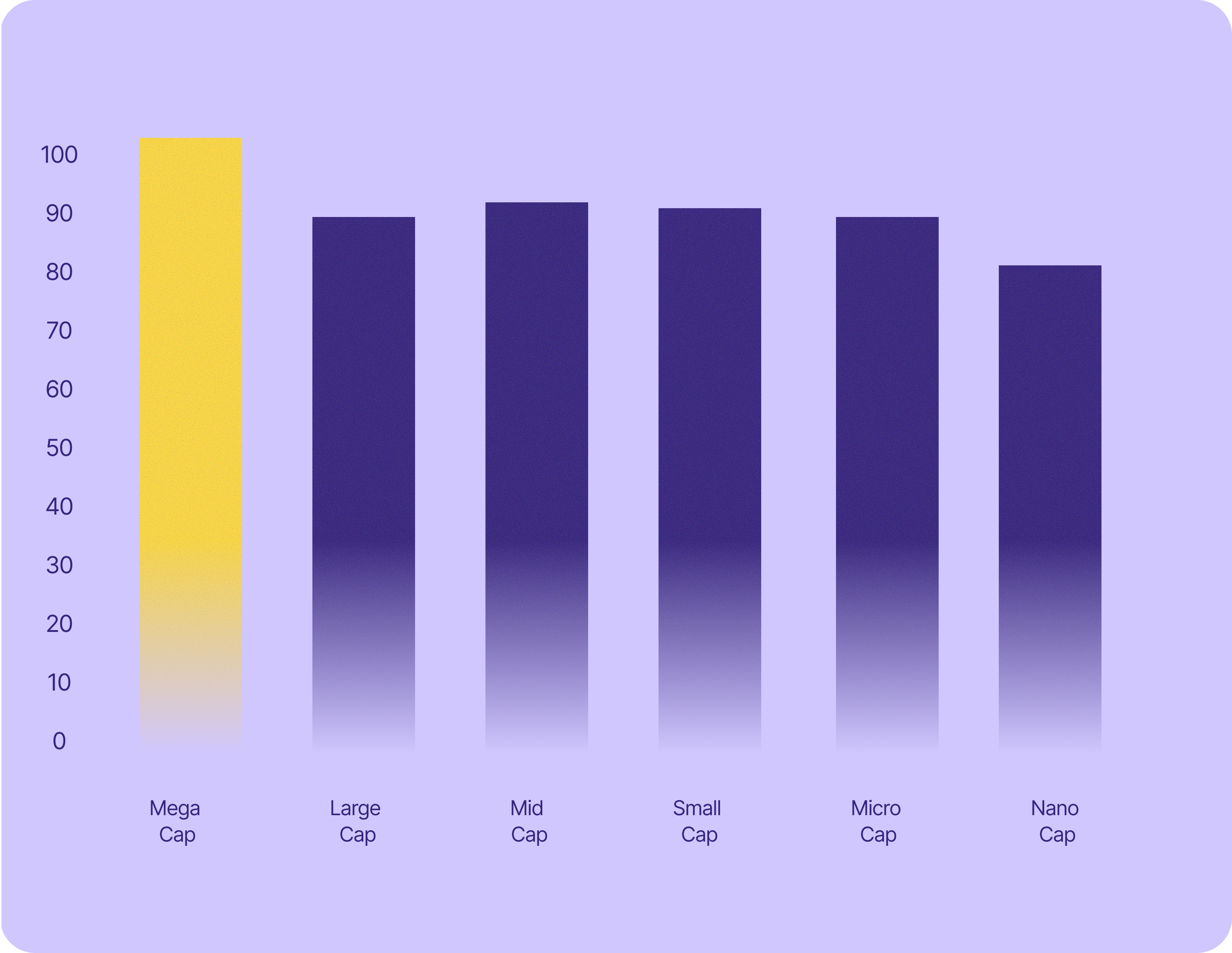

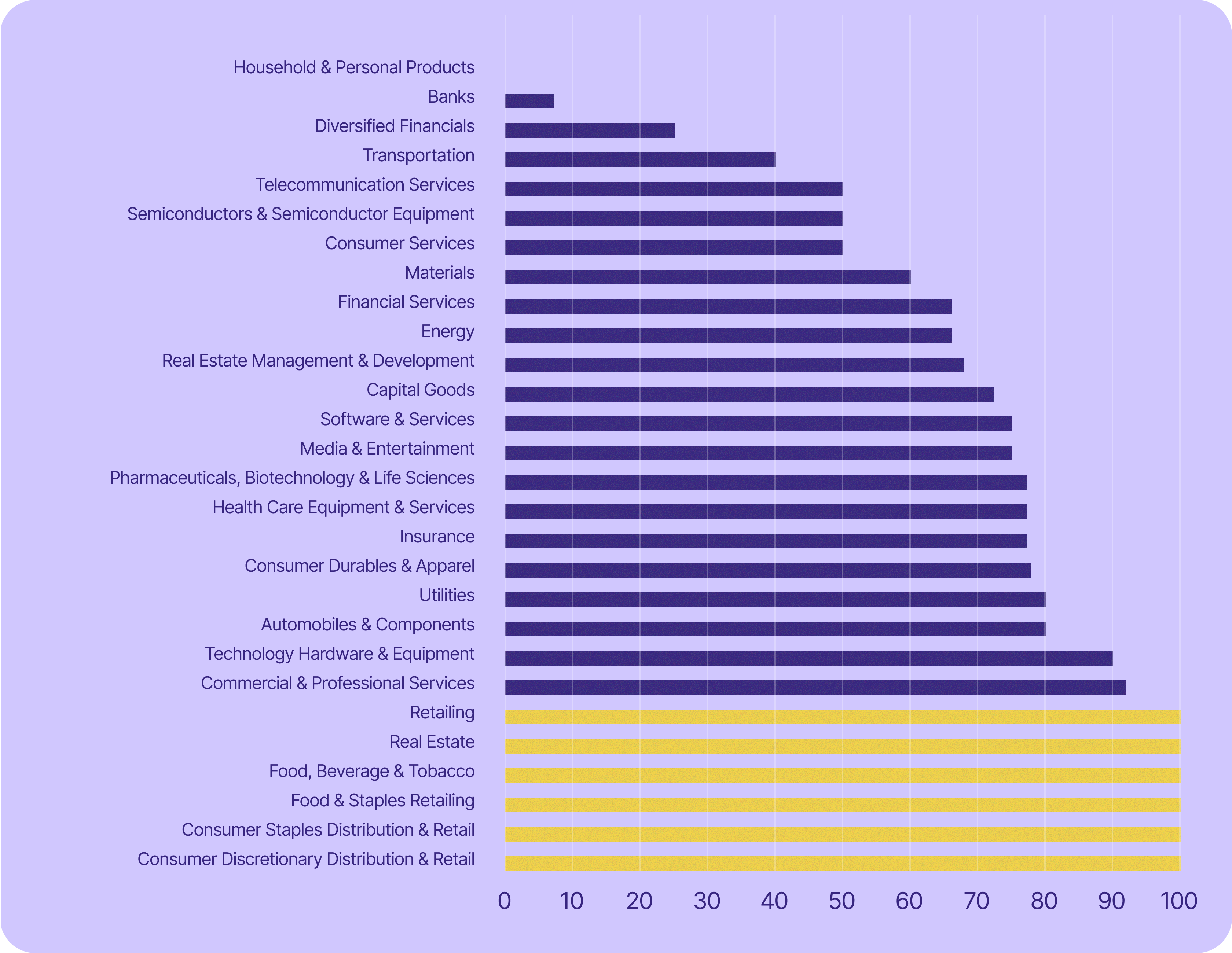

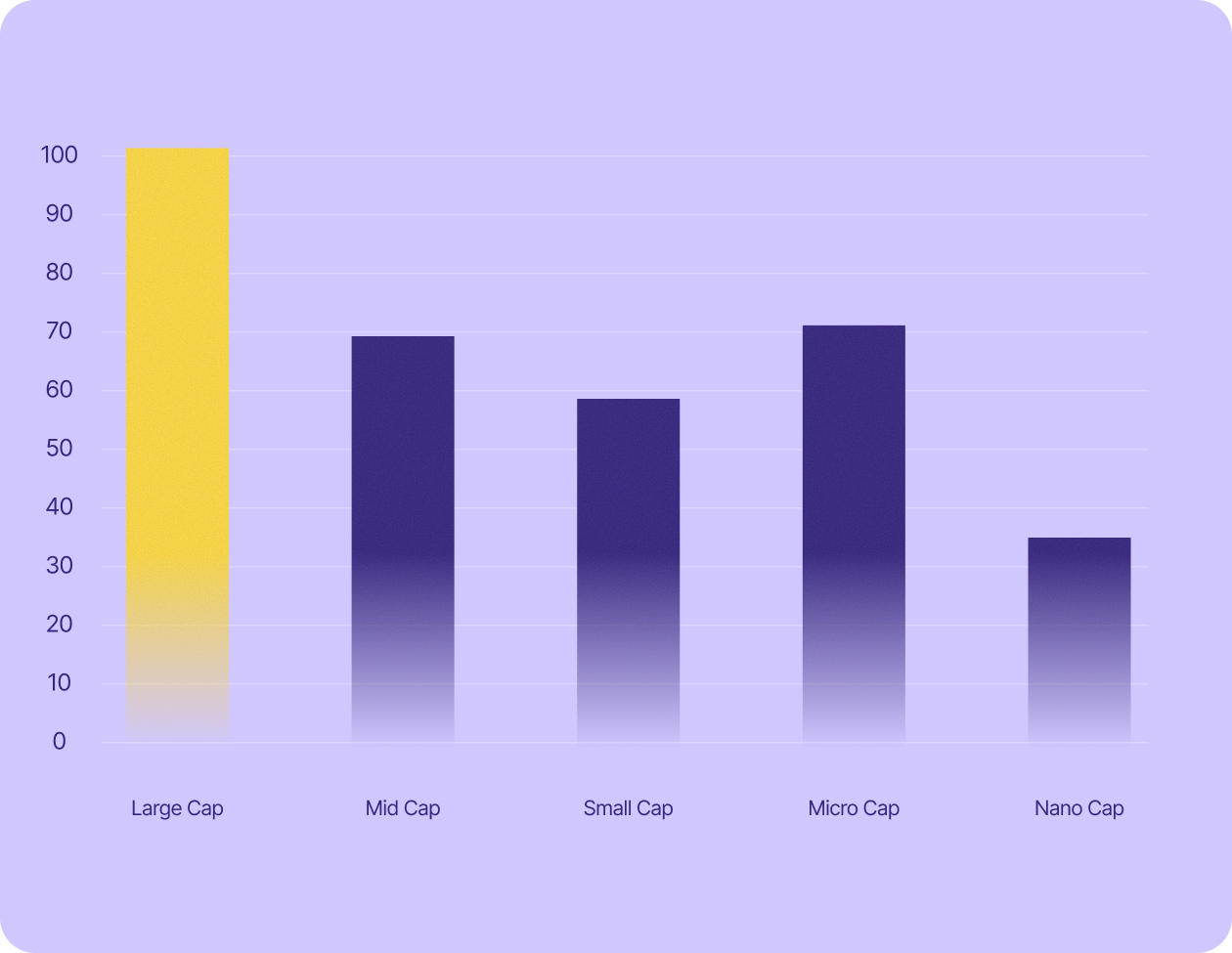

Businesses’ dependence on US tech by market value*

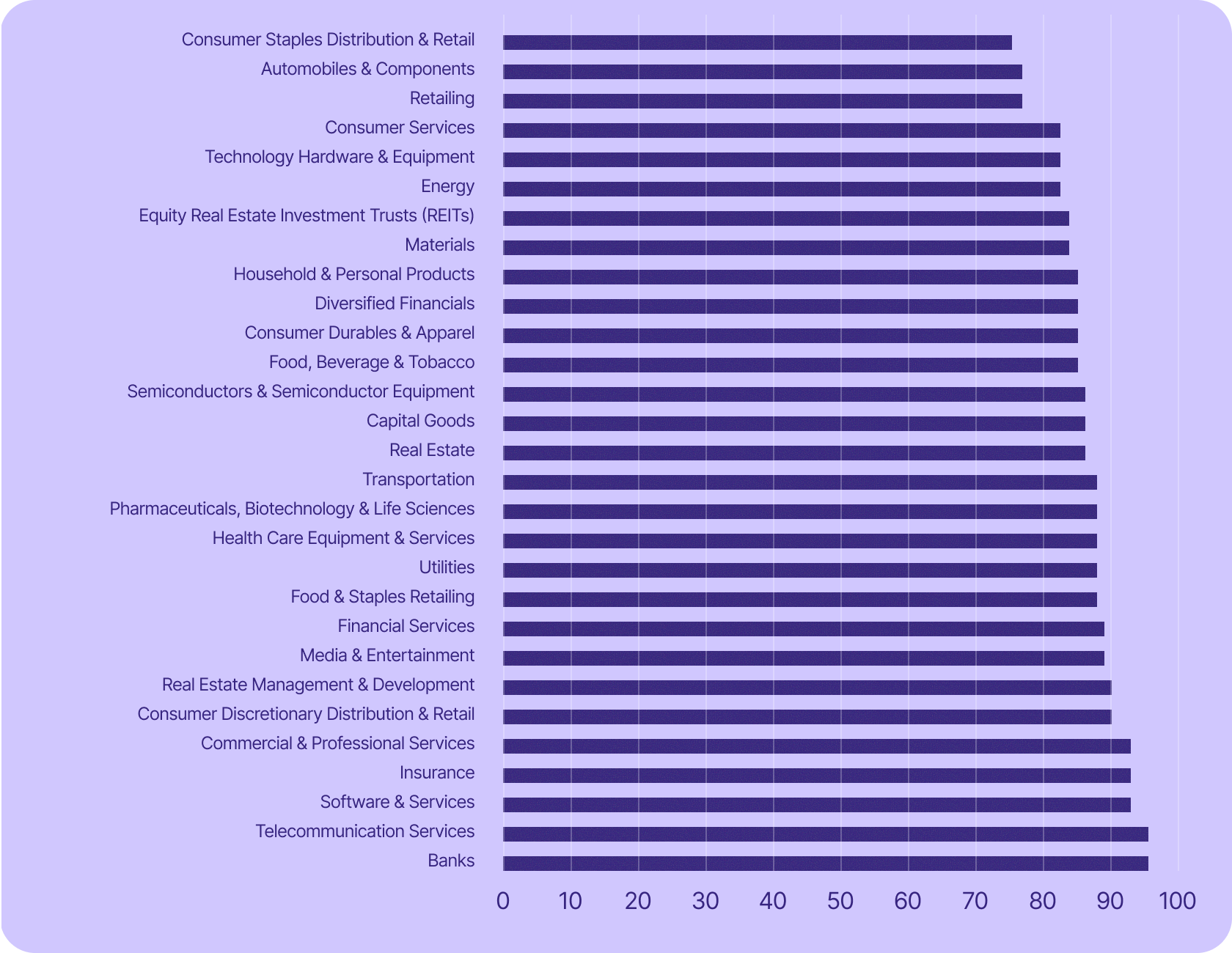

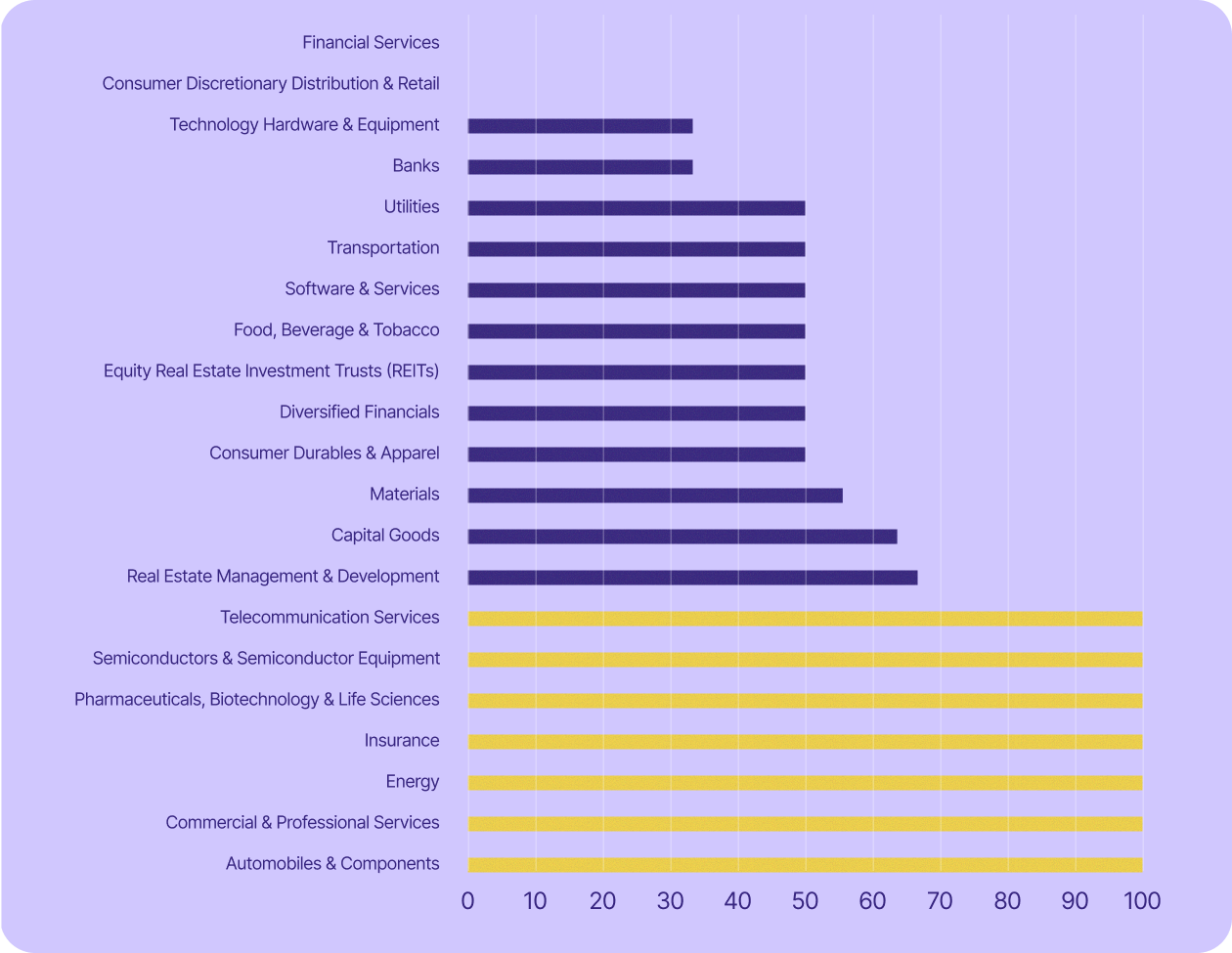

Businesses’ dependence on US tech by sector

66% of French businesses rely on US tech

Roughly two of every three publicly listed businesses in France rely on US tech to handle their emails, an alarming reality for a country that prides itself on being a tech leader of Europe. And the larger the company, the more likely it is to use US tech. Every publicly listed French company worth more than €200 billion uses a US tech stack. Despite France’s push for strategic autonomy, this dependence on foreign tech leaves critical industries vulnerable to external influence, instability, and surveillance.

Some of the most vital sectors are even more dependent. Over 70% of the strategically important French utility sector, which includes electricity, natural gas, and water treatment companies, uses US email services. These services are not optional. That such critical infrastructure relies so heavily on foreign tech for operational communications raises serious national security concerns.

France’s automobile and components industry, one of the country’s largest employers, is also incredibly dependent. Nearly 77% of the industry relies on US tech. In an industry where innovation is key and competition is fierce — and where the US is both a supplier and a rival — this is a strategic blind spot. It’s not just a question of control but resilience. How secure is France’s industrial future when the digital tools powering it come from abroad?

But the most revealing signal comes from France’s homegrown tech sector. Roughly 80% of publicly listed French software and services firms and 79% of technology hardware and equipment companies rely on US services. This structural weakness limits the growth potential of the entire sector and leaves it vulnerable to geopolitical pressure or commercial disruption.

United Kingdom

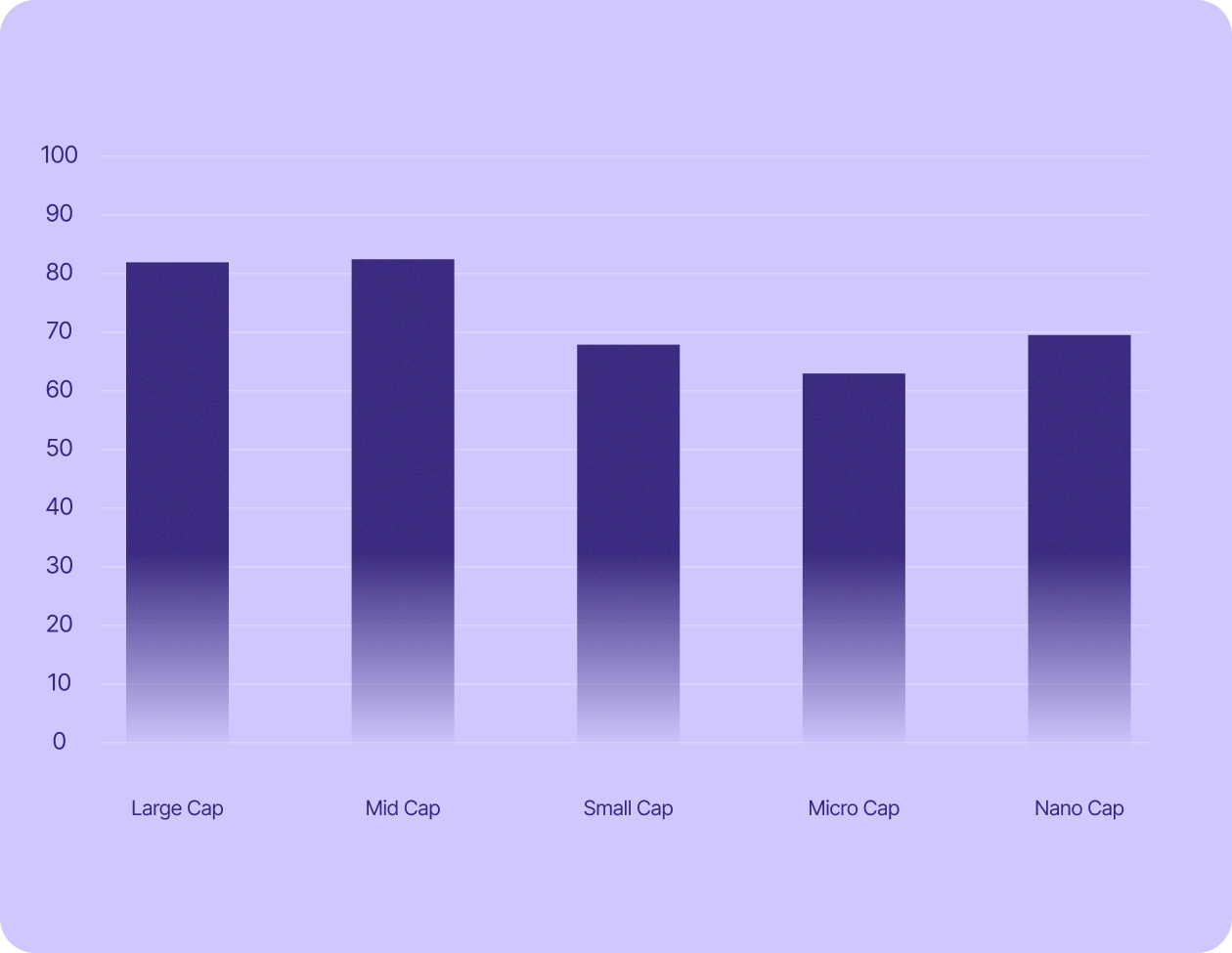

Businesses’ dependence on US tech by market value*

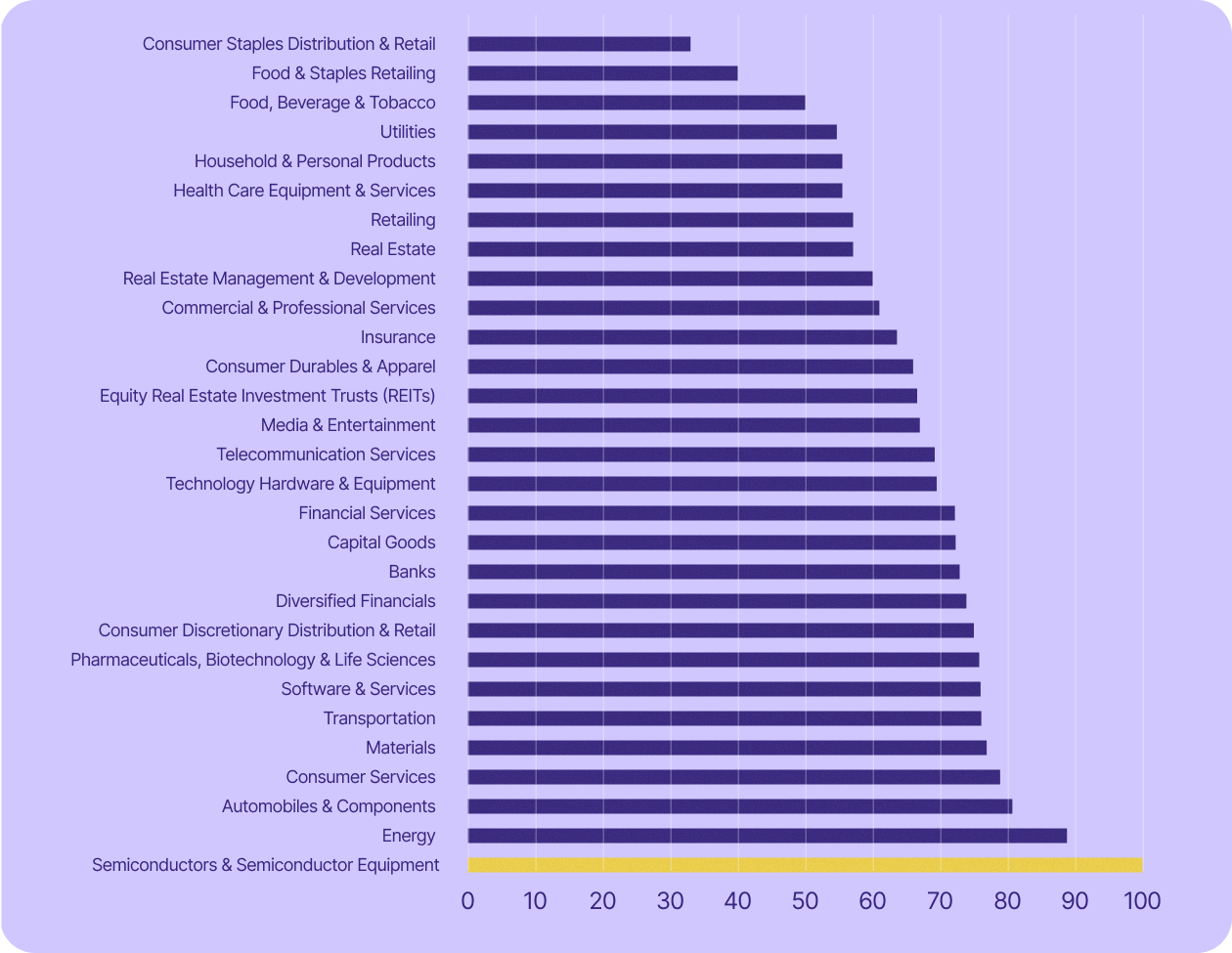

Businesses’ dependence on US tech by sector

88% of UK businesses rely on US tech

UK businesses are almost universally dependent on US tech, regardless of their size. Even within the least reliant segment — companies worth less than €50 million — over 80% of publicly listed businesses rely on US email services. But the UK’s largest corporations are the most dependent group. Every publicly listed company worth more than €200 billion uses US tech. This is shocking for a country home to a tech sector worth $1.1 trillion, the largest in Europe and the third largest globally.

Some of the UK’s most critical industries are also its most exposed. Its banking and telecommunications sectors (both at 95%) are the two most dependent, and nearly 90% of publicly listed utilities companies use US tech. Basically, if Britons want to make a phone call, withdraw cash, or turn on a light, the overwhelming odds are that the infrastructure behind it runs on foreign tech. That’s a critical weakness for any nation’s infrastructure.

Even the UK’s thriving tech scene, which trails only the US and China in valuation, is heavily dependent on US tech. Roughly 94% of publicly listed software and services companies and 82% of technology hardware and equipment companies use US services. This means local talent and capital flow straight into Silicon Valley rather than strengthening domestic capabilities. This dependence doesn’t just prevent the UK tech sector from closing the gap with the US — it makes the sector incredibly reliant on a direct competitor just to maintain its current position.

Ireland

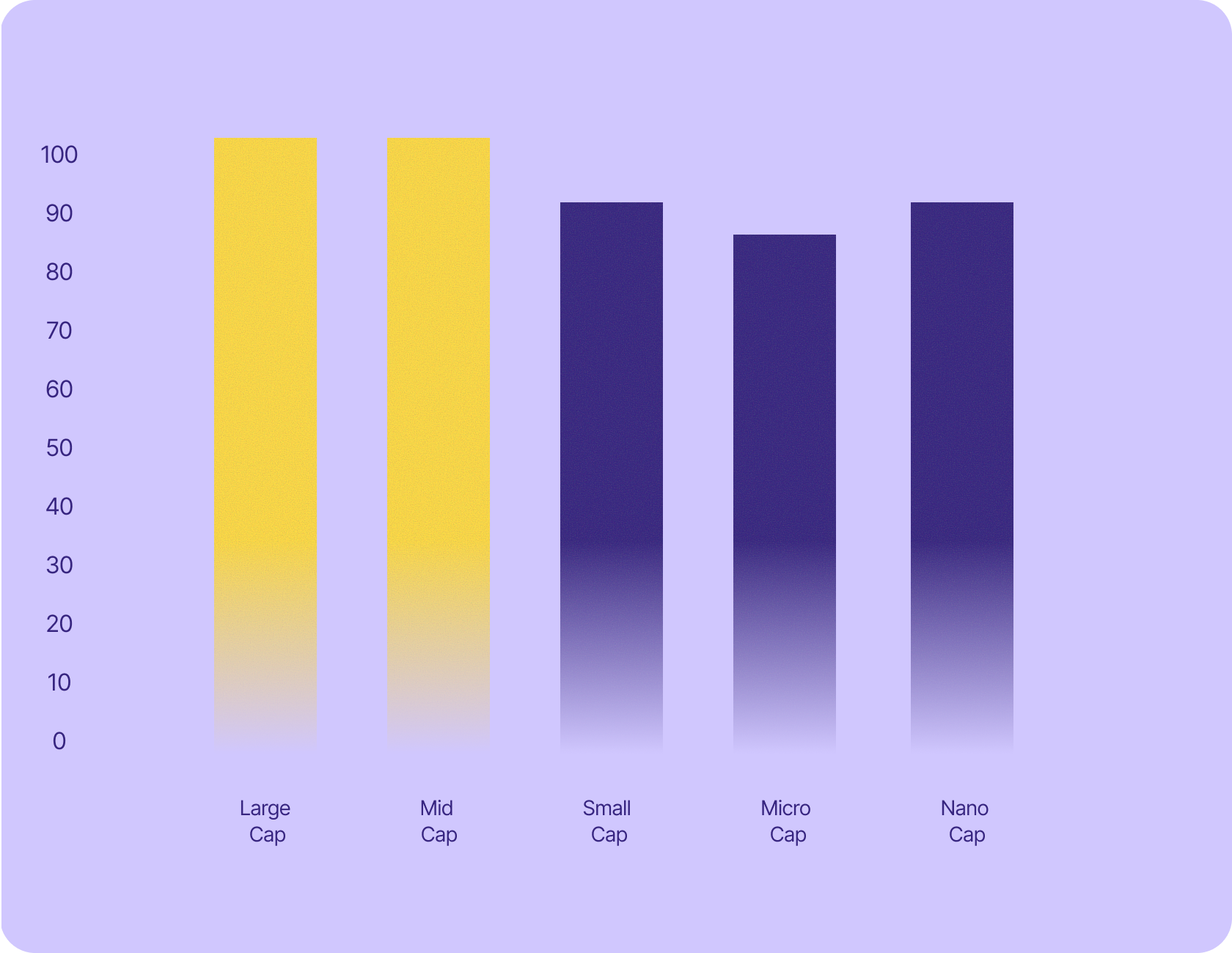

Businesses’ dependence on US tech by market value*

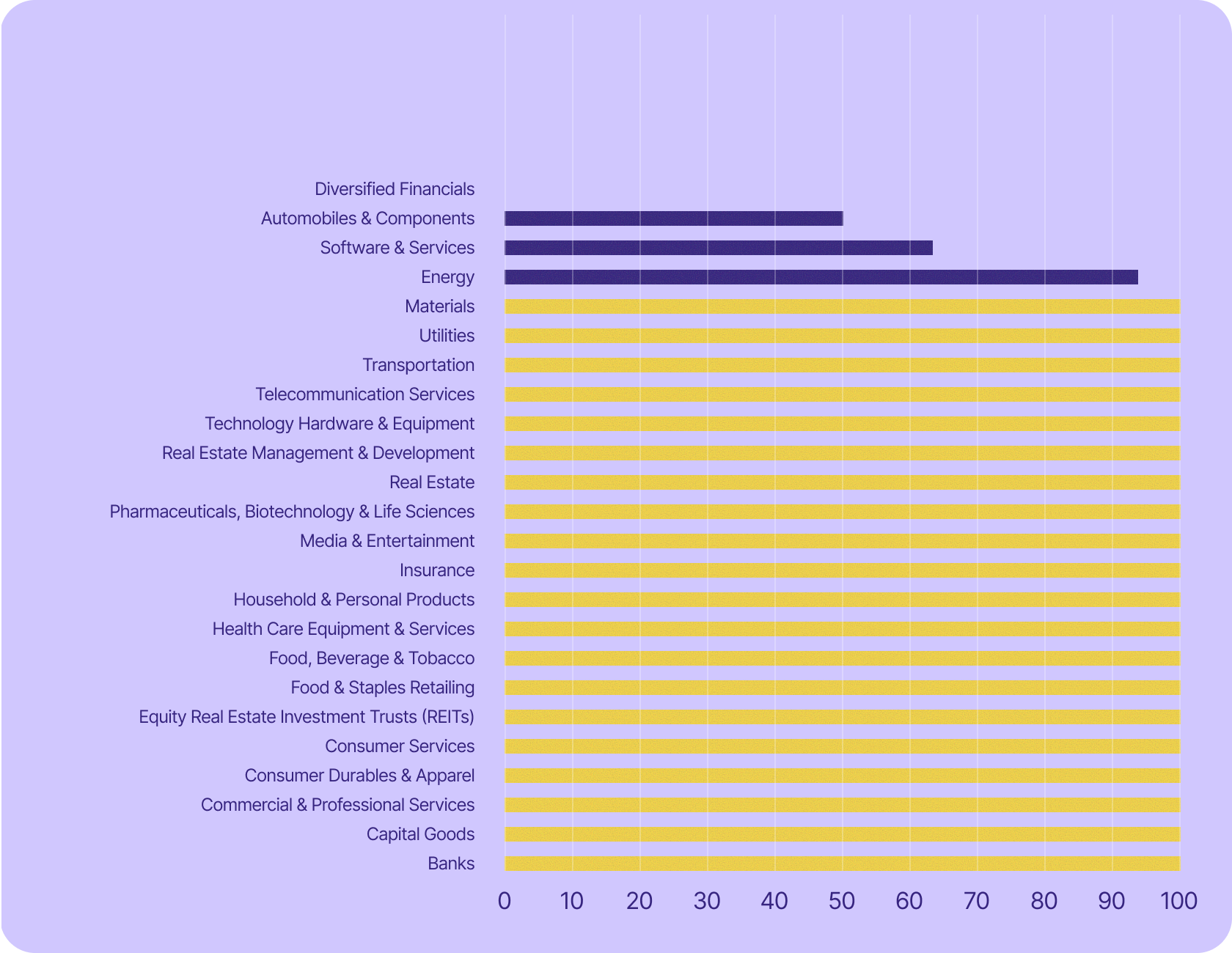

Businesses’ dependence on US tech by sector

93% of Irish companies rely on US tech

Ireland has become Big Tech’s outpost of choice in the EU, with Apple, Meta, Google, and Microsoft all basing their European headquarters there. This helps explain how US tech has become so embedded in its publicly listed companies. In 19 economic sectors, every Irish business depends on US companies to handle its email. These sectors include essential services, such as communications, utilities, and health care.

If access to these US platforms were restricted, core Irish services — from patient care to being able to turn on the lights — could be disrupted. Ireland is also incredibly exposed economically. In addition to relying on US tech companies for tax revenue and thousands of high-paying jobs, all publicly listed companies in Ireland’s pharmaceutical and biotech sector, a cornerstone of its export economy, use US tech.

For a country that hosts so many multinational firms and boasts a well-educated workforce, Ireland’s overreliance on US tech is a strategic liability. The only sectors of the Irish economy where fewer than 50% of publicly listed companies use US tech are diversified financials and automobiles and components. Ireland’s preferential treatment of US tech has crowded out homegrown alternatives, stifled innovation, and left entire industries vulnerable to decisions made outside of Europe.

Spain

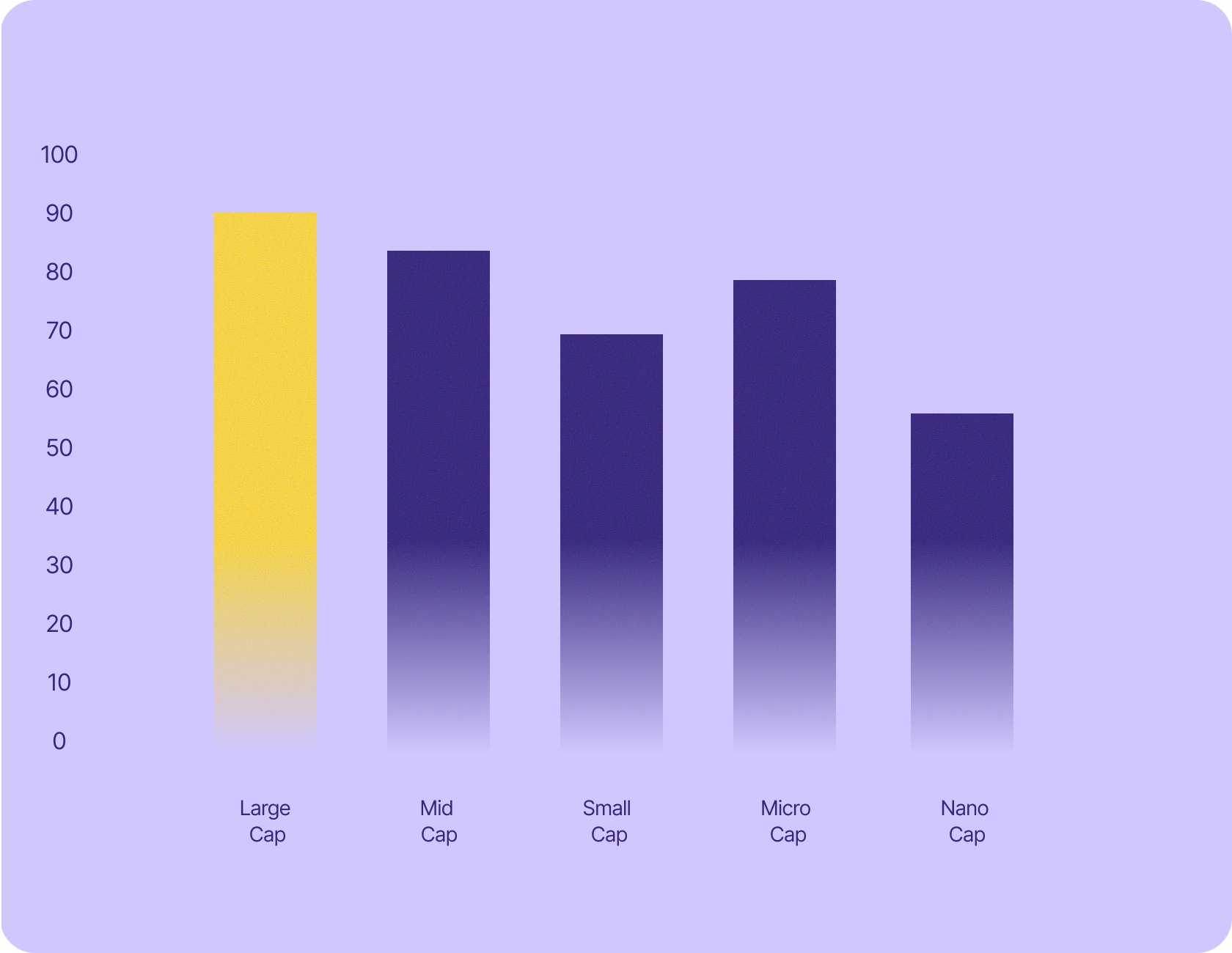

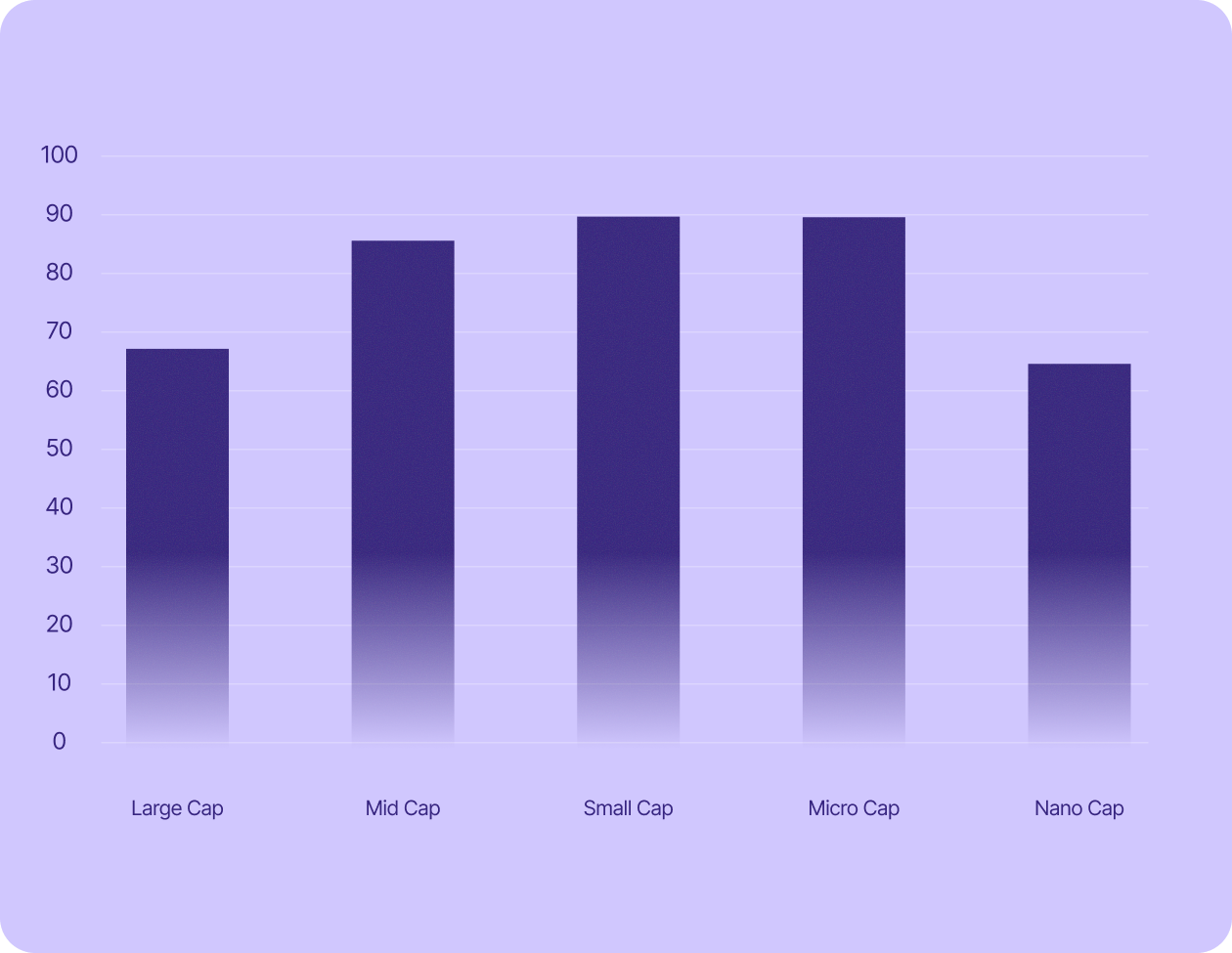

Businesses’ dependence on US tech by market value*

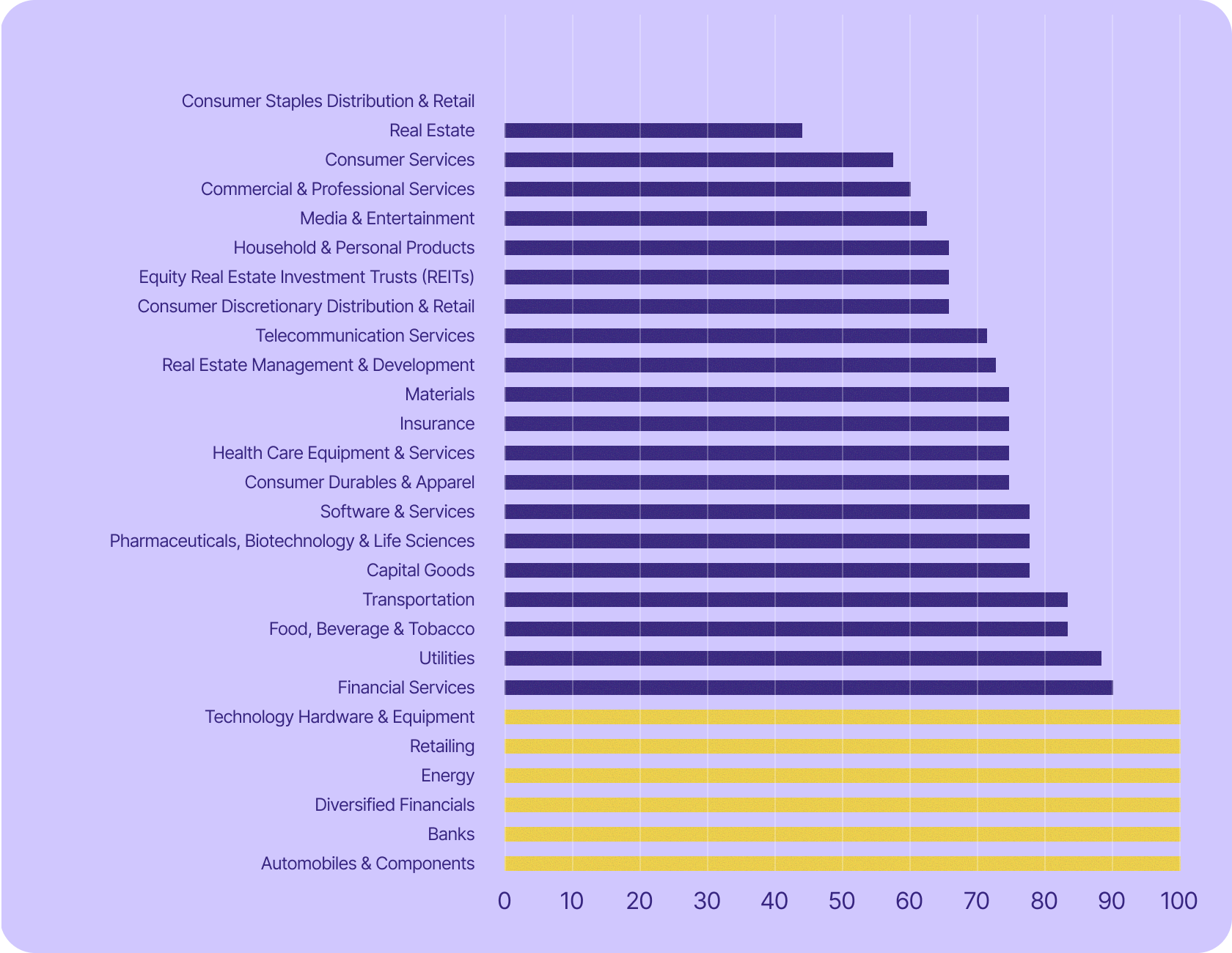

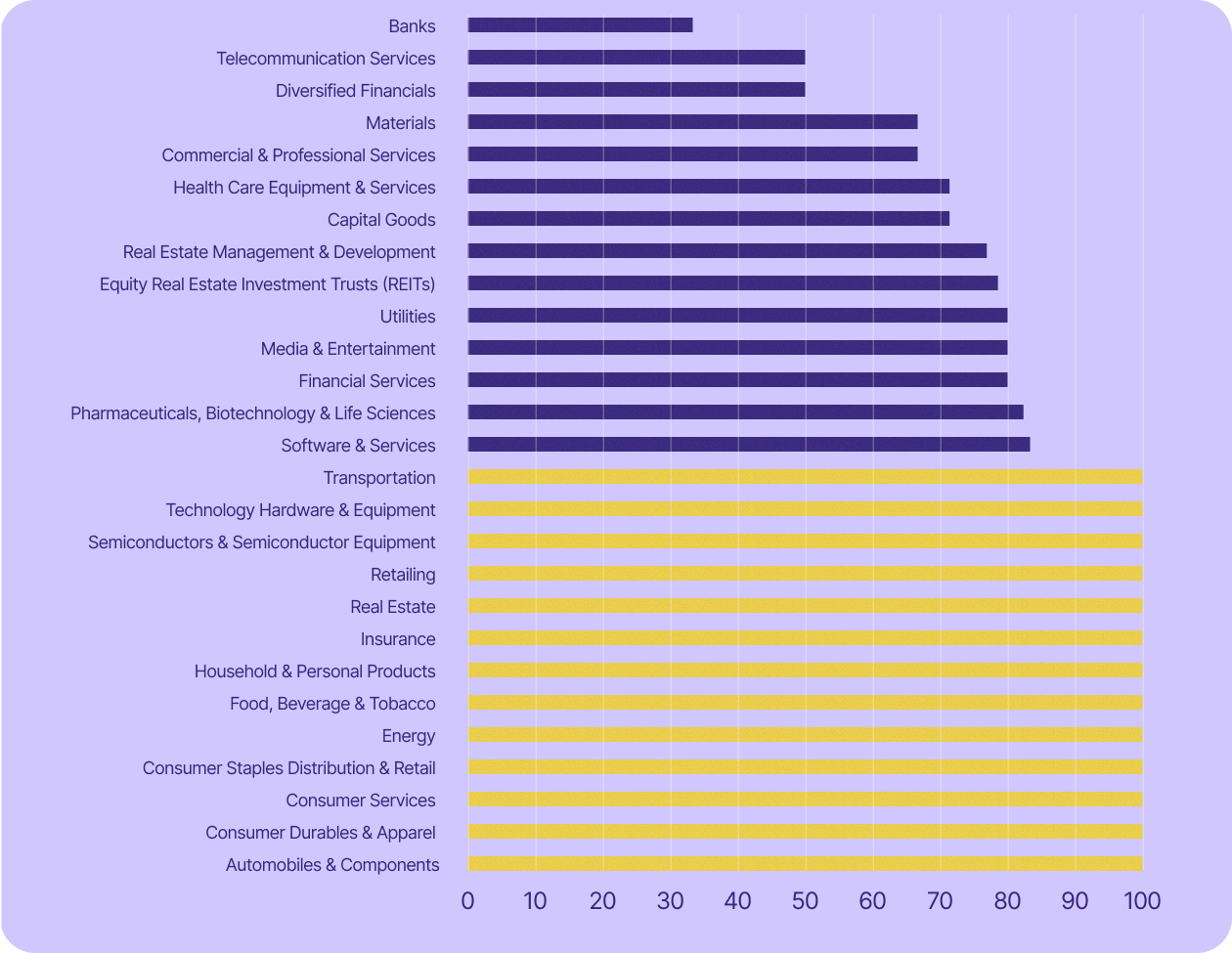

Businesses’ dependence on US tech by sector

74% of Spanish businesses rely on US tech

In Spain, at least two of every three publicly listed companies worth more than €50 million rely on US tech to function. This dependency grows as these companies scale. The larger they get, the more likely they are to use services like Microsoft or Google. This suggests that many companies see US tech ecosystems as the only viable option once they reach a certain size. This should be a wake-up call for Spain’s tech sector and the whole EU: If local providers can’t develop tools to serve companies in their back yard, how can they compete globally?

There are six economic sectors in Spain where 100% of the businesses rely on US software, including the critical energy and banking industries. In other sensitive sectors, like utilities (such as electricity, water treatment, or sewage), transportation, software and services, and health care, at least 75% of publicly listed companies rely on US tech. This remarkable level of dependence is more than a business risk — it’s a potential national security threat, giving a foreign power leverage over essential industries that the Spanish public uses every day.

Portugal

Businesses’ reliance on US tech by market value*

Businesses’ dependence on US tech by sector

72% of Portuguese businesses rely on US tech

While Portugal’s economy is relatively modest, it’s still striking to see how many sectors rely entirely on US tech. Nearly three-quarters of publicly listed companies use US-based email, including every single company in nine major economic sectors.

These fully reliant sectors include essential services like energy, transportation, and banking, systems that people can’t avoid. If the US wanted to exert pressure, it could compel these services to raise prices or restrict access altogether, potentially disrupting everything from train schedules to ATM networks. This isn’t a hypothetical scenario. These are serious vulnerabilities within Portugal’s national infrastructure.

Even worse, all of Portugal’s publicly listed software and IT services companies rely on US tech to get work done. This doesn’t just limit their ability to compete on the global stage — it prevents homegrown alternatives from developing, entrenching the very dependency Portugal should be trying to escape.

Switzerland

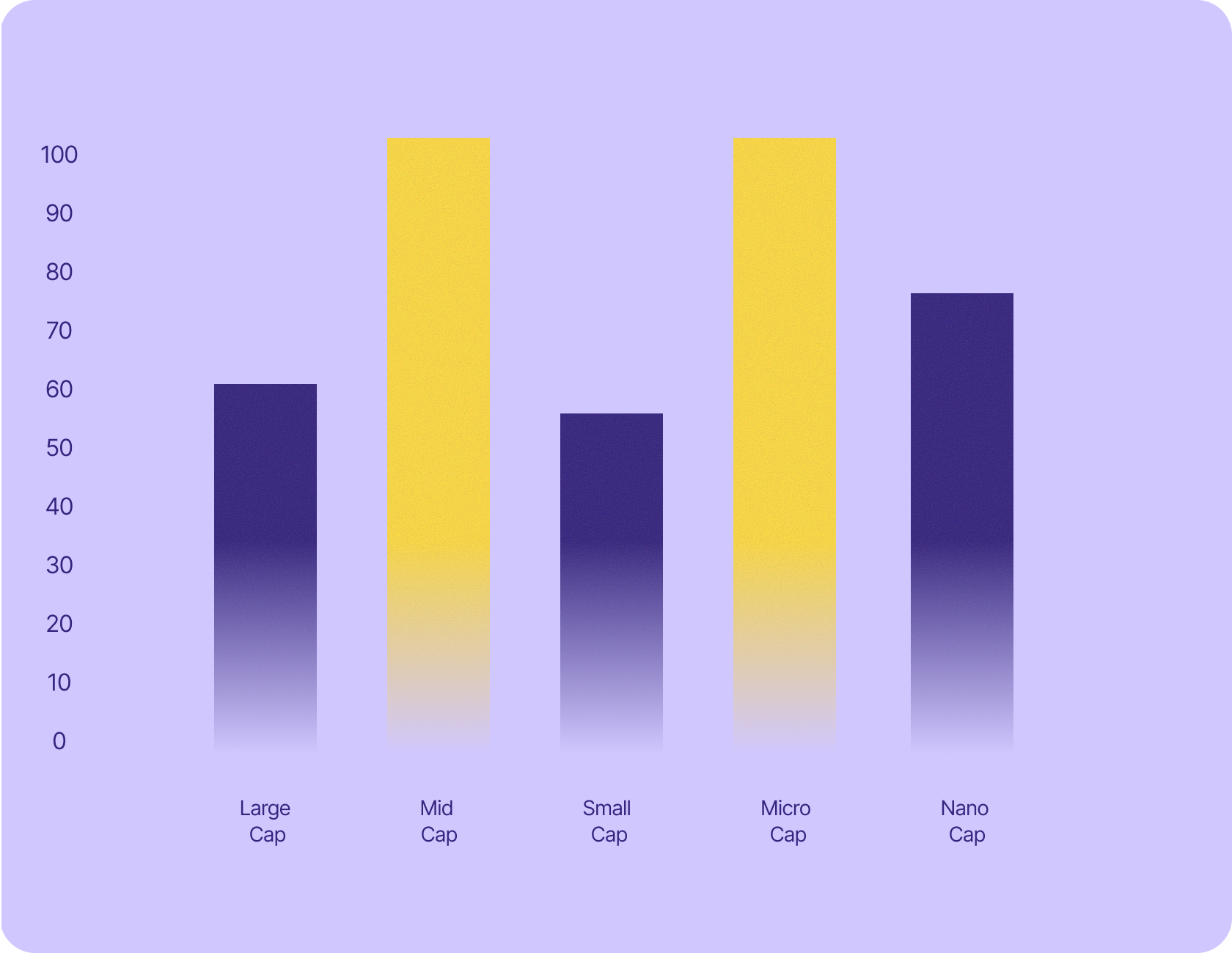

Businesses’ dependence on US tech by market value*

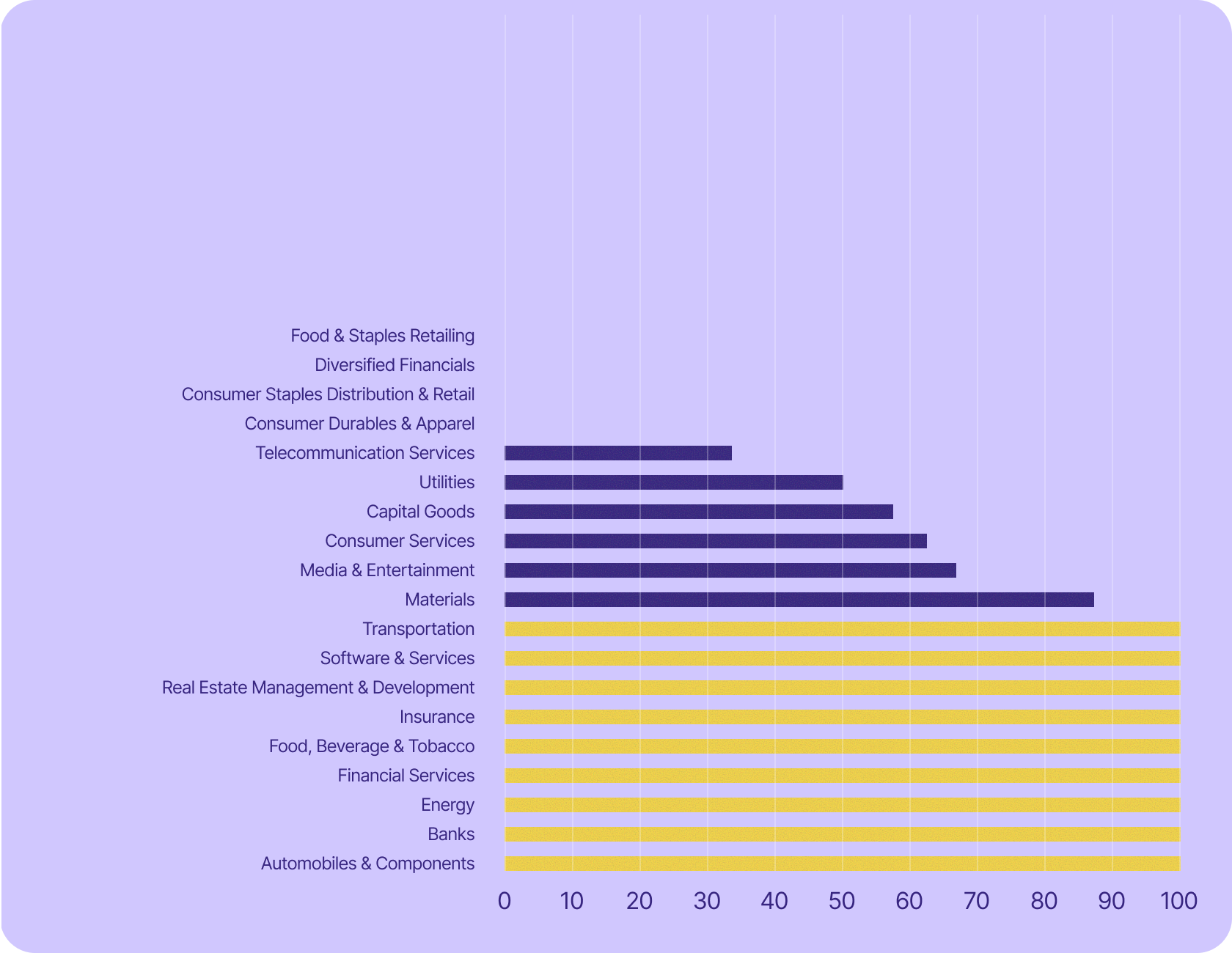

Businesses’ dependence on US tech by sector

68% of Swiss businesses rely on US tech

Two of every three publicly traded Swiss companies rely on US email service providers to run their day-to-day operations. Even worse, 80% of publicly traded utilities companies, 77% of health care providers, and 67% of energy companies use US tech, leaving critical infrastructure exposed to geopolitical pressure. For a country that’s built its reputation on independence and neutrality, this is a massive vulnerability.

Some of the sectors most critical to the Swiss economy are even more exposed. The service industry, which includes banking, finance, insurance, and professional services (among others), accounted for 70% of the country’s GDP in 2023 and employed 78% of its workforce in 2024. In all these sectors (except banking), at least 67% of publicly traded companies use US tech.

Exports are another cornerstone of the Swiss economy, powered by its pharmaceuticals sector. In 2023, packaged medicaments and vaccines were its second- and third-most valuable exports (behind gold), worth a combined $80 billion. Yet 77% of publicly traded companies in this foundational sector rely on US tech to communicate and operate.

This is more than a question of which technology stack to use. The heart of Switzerland’s economy runs on digital infrastructure from the US, meaning its economic future and ability to act independently on the world stage depend on decisions made far from Bern or Zurich.

Germany

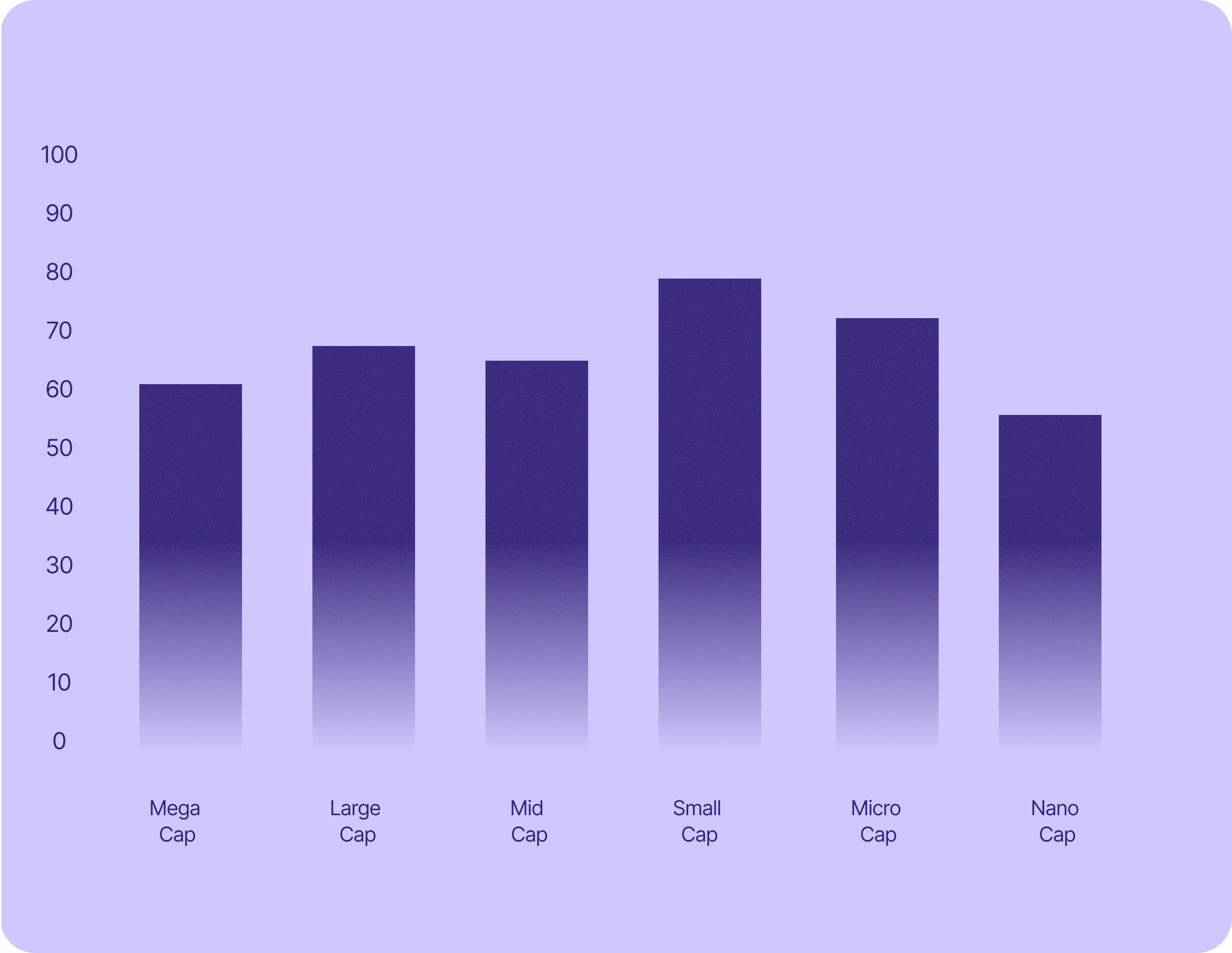

Businesses’ reliance on US tech by market value*

Businesses’ dependence on US tech by sector

58% of German businesses rely on US tech

All of Germany’s largest publicly listed companies use US email providers. These companies power the German economy, and because Germany is the EU’s largest economy, they’re major contributors to EU economic performance. Yet they all rely on tech infrastructure that is controlled from abroad and subject to foreign jurisdiction.

Germany’s economy has long been driven by advanced, high-value exports, like automobiles, pharmaceuticals, and semiconductors and electrical equipment. In 2023, cars and automobile parts were Germany’s two main exports, making up €246.5 billion. Packaged medicaments were the third most valuable export, at €68 billion, and integrated circuits contributed another €20 billion. And in each of these industries, a majority of publicly listed companies use US tech: automobiles at 53%, semiconductors at 69%, and pharmaceuticals at 70%.

Vital service providers in Germany show the same dependency. Roughly 67% of publicly listed transportation companies, 63% of utility companies, and 59% of telecommunications companies use US email. That means the services that run Germany’s trains, energy grid, and internet are vulnerable to outside pressure, putting economic resilience and public trust at risk.

Austria

Businesses’ dependence on US tech by market value*

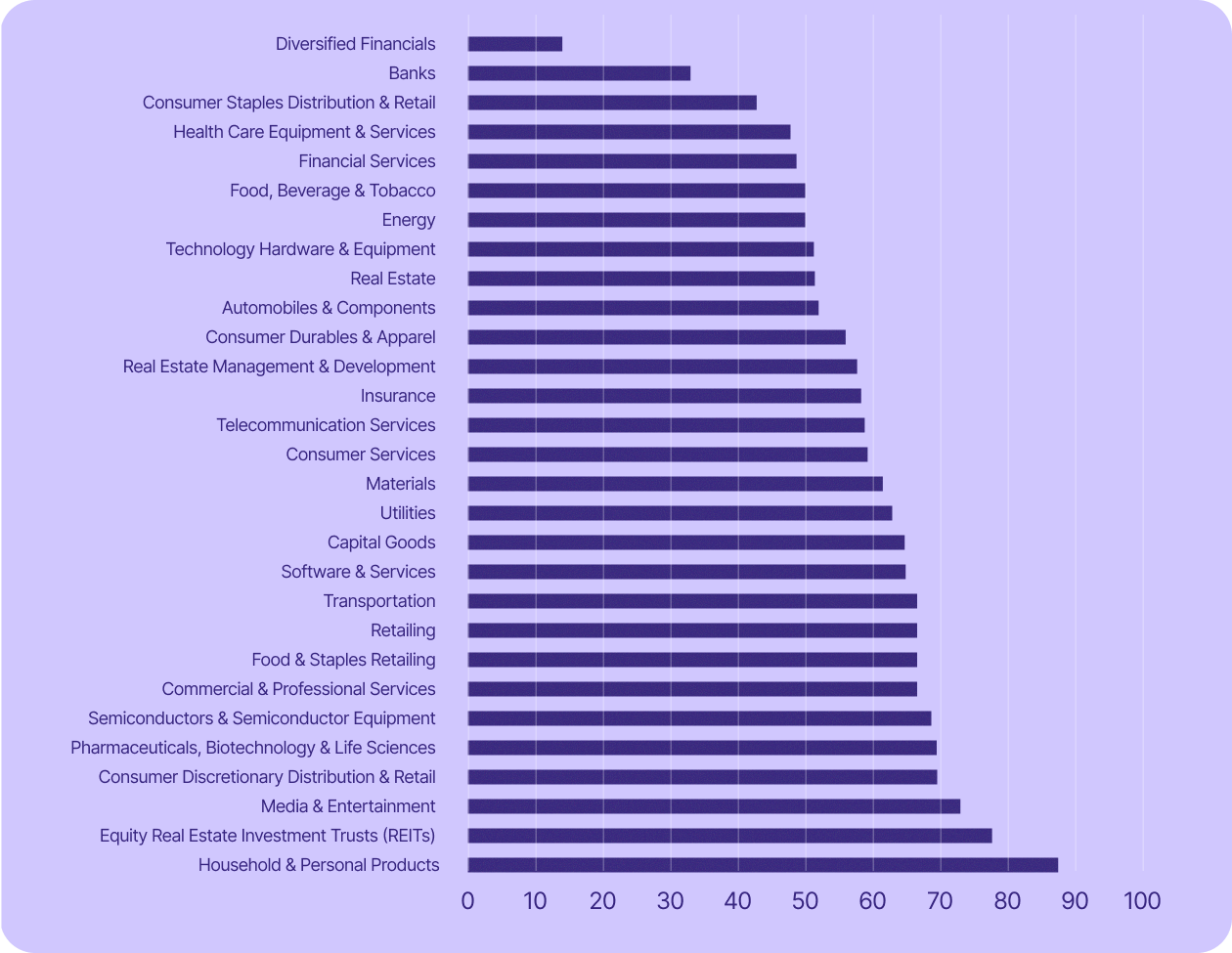

Businesses’ dependence on US tech by sector

59% of Austrian businesses rely on US tech

Austria’s largest publicly listed companies all use US email services. These are the country’s biggest, most productive companies, and they all rely on tech infrastructure controlled by corporations based abroad. This means that the Austrian economy itself is vulnerable to foreign influence.

In seven key sectors, every publicly listed company depends on US tech. These include industries that are either strategically important or central to Austria’s economic performance. In 2022, its automobile sector employed roughly 200,000 people and generated €28 billion. The country received EU funding to bolster its semiconductor production, and its pharmaceuticals and life science sector accounts for roughly 7% of the country’s GDP. When all the publicly listed companies in these sectors rely on US tech, it creates a critical point of failure at the core of the national economy.

Italy

Businesses’ reliance on US tech by market value*

Businesses’ dependence on US tech by sector

69% of Italian businesses rely on US tech

Two in three publicly listed companies in Italy use US-based email services for their communications. If you focus on its largest publicly listed companies, this rate increases to four in five. This includes companies operating in industries the Italian and European governments have named strategic for long-term growth and resilience.

The EU designated semiconductors a strategically important sector with its CHIPS Act in 2023, and Italy has declared its ambition to be a leader in this industry. The country committed €10 billion in 2024 to grow its domestic microelectronic production. Yet every single publicly listed Italian semiconductor company relies on US tech. This means sensitive business data in a sector prioritized by the EU for its sovereignty is subject to a foreign jurisdiction.

Despite recent challenges, the Italian automobile manufacturing industry remains vital to Italy’s economy. As of 2024, this sector employed more than 170,000 people and was responsible for over 6% of Italy’s manufacturing production. But more than 80% of publicly listed auto manufacturers use US-based tech. This creates risk — especially when the US is both a key trade partner and competing auto producer. Any service disruption could impact Italian auto companies that are already trying to navigate a complex global market.

Belgium

Businesses’ dependence on US tech by market value*

Businesses’ dependence on US tech by sector

80% of Belgian businesses rely on US tech

Four in five publicly listed companies in Belgium use US email services, including every publicly listed business in 13 different sectors. Vital services that Belgians rely on every day are also deeply dependent. Four in five publicly listed utilities companies and every transportation and energy company use US-based providers. This means the systems that keep the trains running, electricity flowing, and water clean all depend on foreign infrastructure.

One of Belgium's most critical sectors is its pharmaceutical and life science industry — and four in five publicly listed Belgian pharma companies use US tech. That leaves this vital industry, which employs more than 30,000 people and accounts for roughly 10% of Belgium’s exports, exposed to geopolitical pressure.

The Netherlands

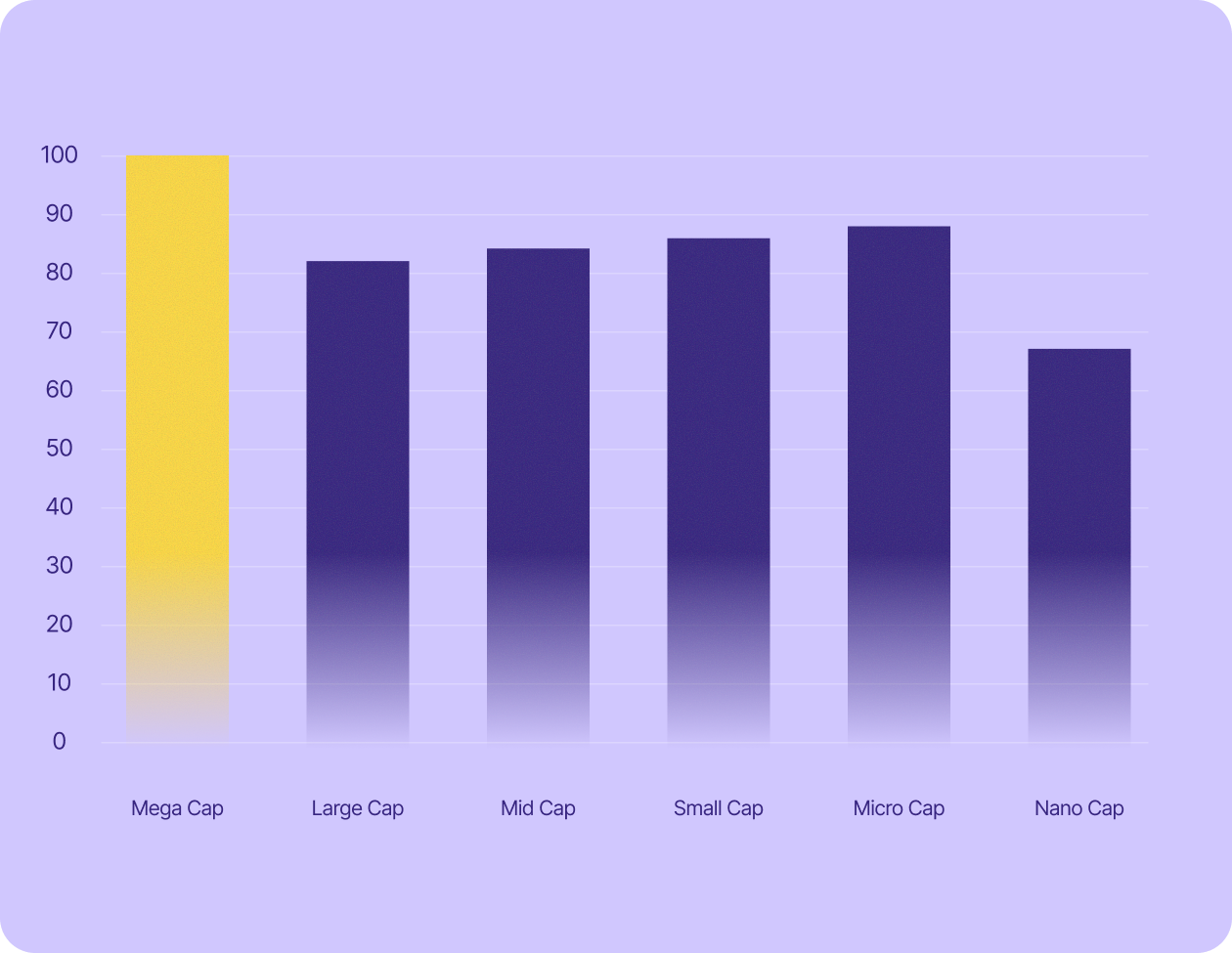

Businesses’ reliance on US tech by market value*

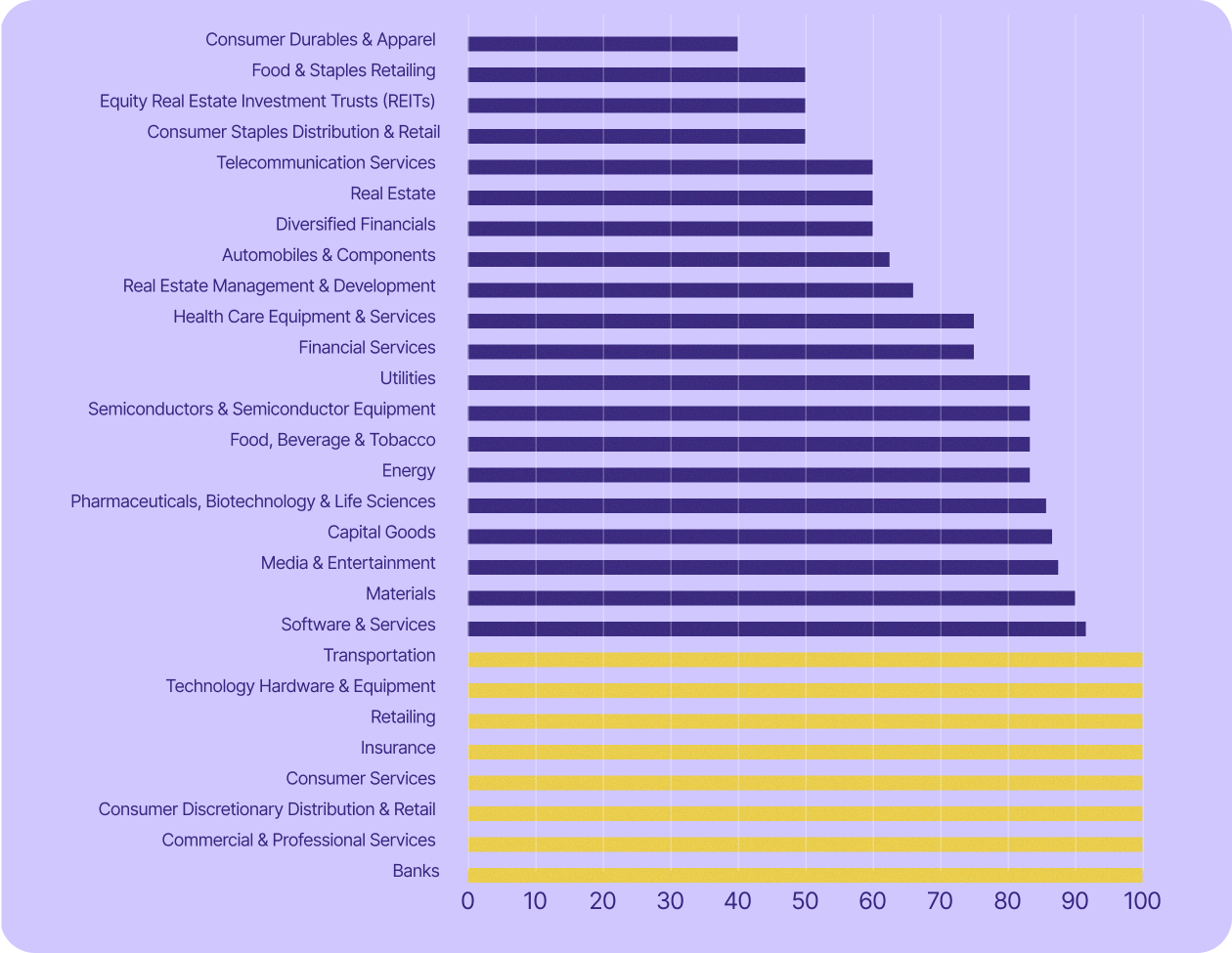

Businesses’ dependence on US tech by sector

81% of Dutch businesses rely on US tech

Every single publicly listed business in the Netherlands worth more than €200 billion uses a US-based email service, along with every publicly listed company in eight sectors. Overall, four in five publicly listed Dutch companies use US tech. This means wide swaths of the Dutch economy are vulnerable to disruption.

The Netherlands is home to a world-class semiconductor industry, with several companies playing an essential role in the AI supply chain. This sector is not only strategically important for Europe’s future but also a cornerstone of the Dutch economy, generating €29 billion in revenue and employing roughly 60,000 people in 2022. However, 83% of the publicly listed companies in this sector use US tech. These companies’ sensitive business information, which is crucial to industries of the future, is stored on systems governed by a foreign power’s legal system.

Luxembourg

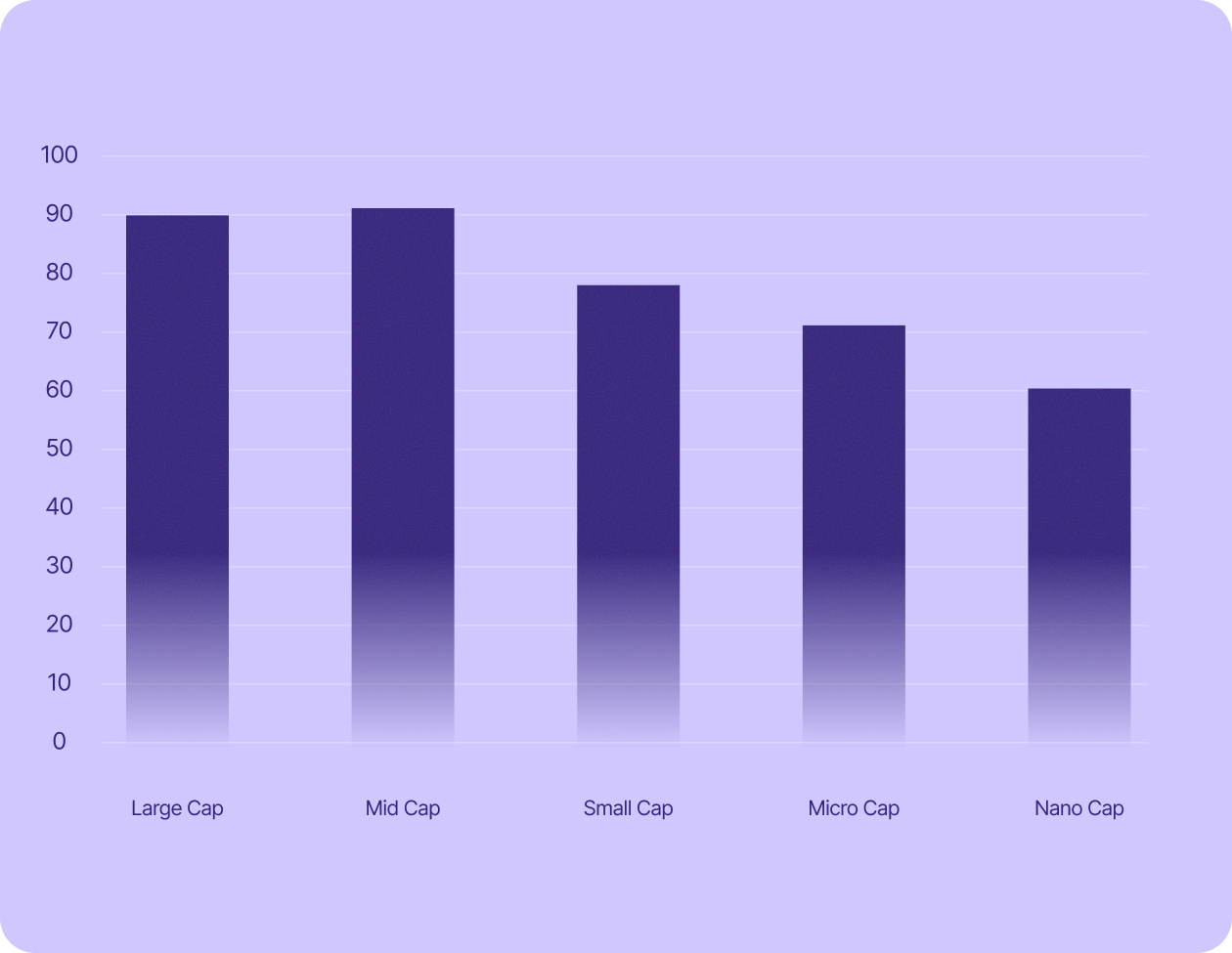

Businesses’ dependence on US tech by market value*

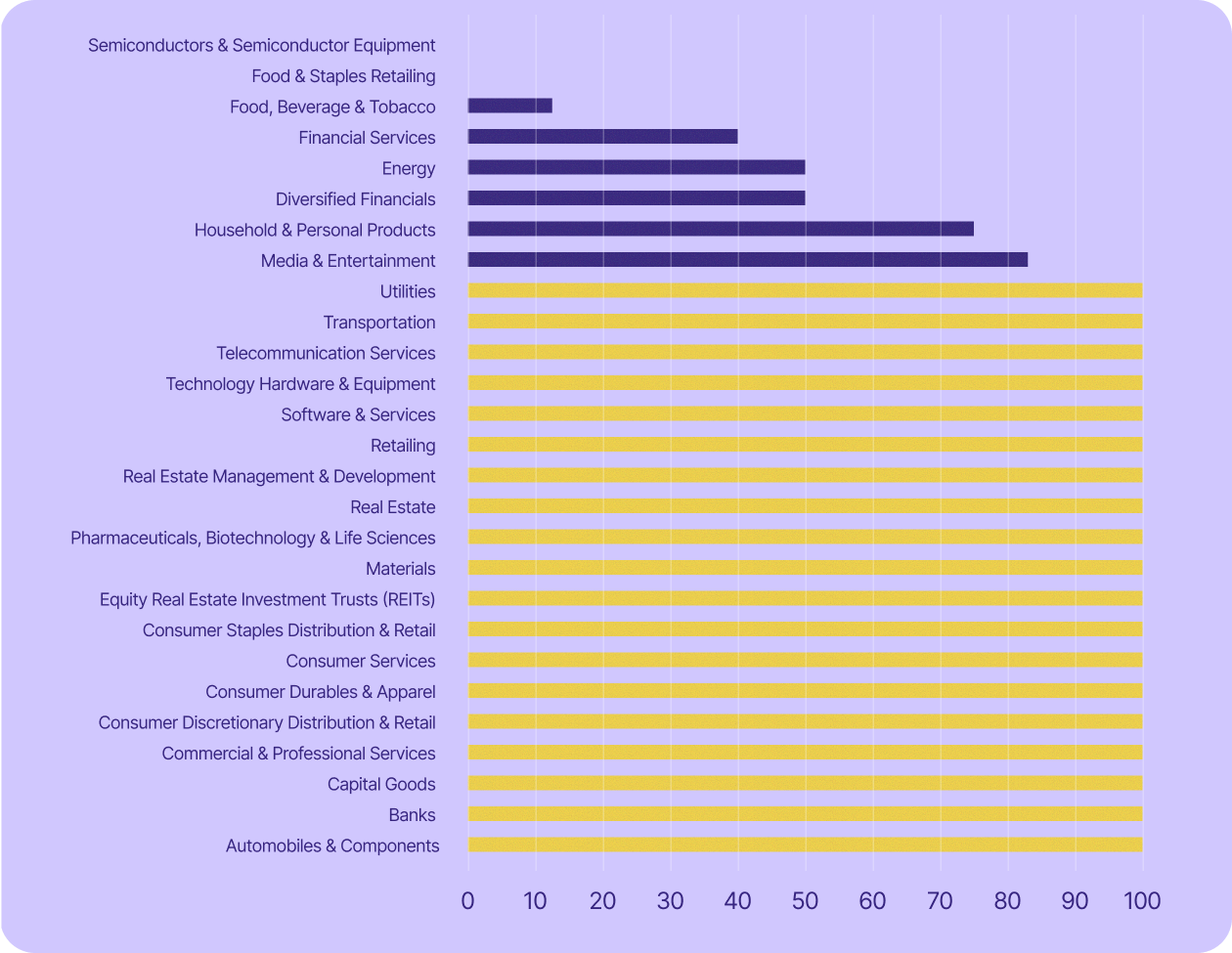

Businesses’ dependence on US tech by sector

78% of Luxembourgish businesses rely on US tech

While Luxembourg is one of the smallest countries and economies in the EU, it is still striking to see how dependent its publicly listed companies are on US email infrastructure. Nearly four in five use a US service provider, including every publicly listed company in 19 sectors. This means an overwhelming majority of the Luxembourgish economy relies on tech infrastructure subject to another country’s laws and political realities.

Luxembourg is a well-known international finance center, and nothing is more important than its banking sector. In 2023, Luxembourgish banks contributed roughly €16.8 billion, 23% of the country’s GDP, and employed nearly 65,000 people, 14% of the country's workforce. Yet 100% of its publicly listed banks rely on US tech. This creates a serious point of exposure for a country whose economic stability depends so heavily on a single sector.

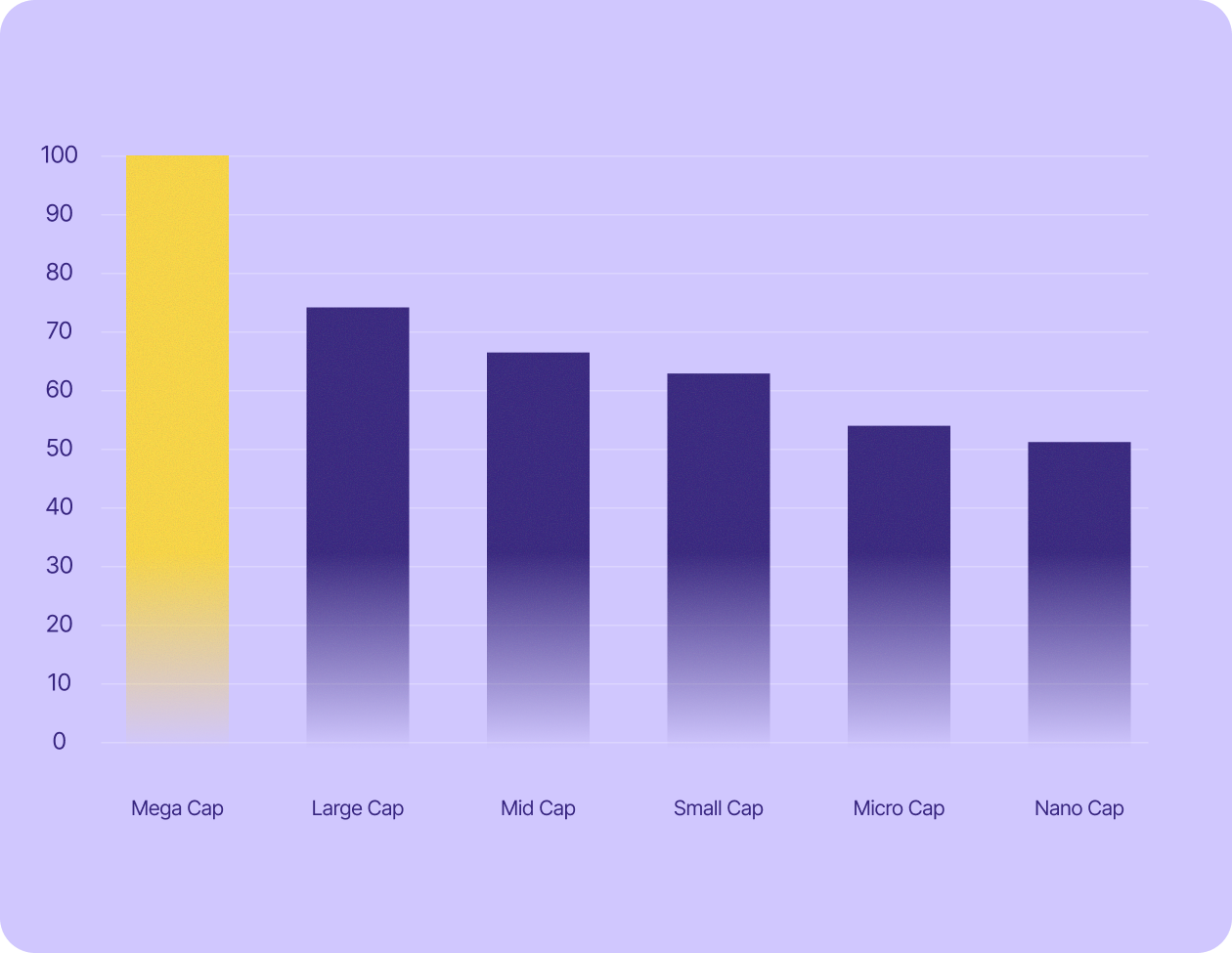

*Nano: Under €50 million | Micro: €50 million–€300 million | Small: €300 million–€2 billion | Mid: €2 billion–€10 billion | Large: €10 billion-€200 billion | Mega: Over €200 billion

Take control of your data

European businesses can’t afford to depend on foreign tech providers. Take control by switching to Proton, a secure, privacy-first suite of services that keeps your data in Europe.

Protect your data and your business.

Frequently asked questions

- How did Proton find this information?

- What are some examples of US tech services?

- Why do some countries show fewer sectors than others?